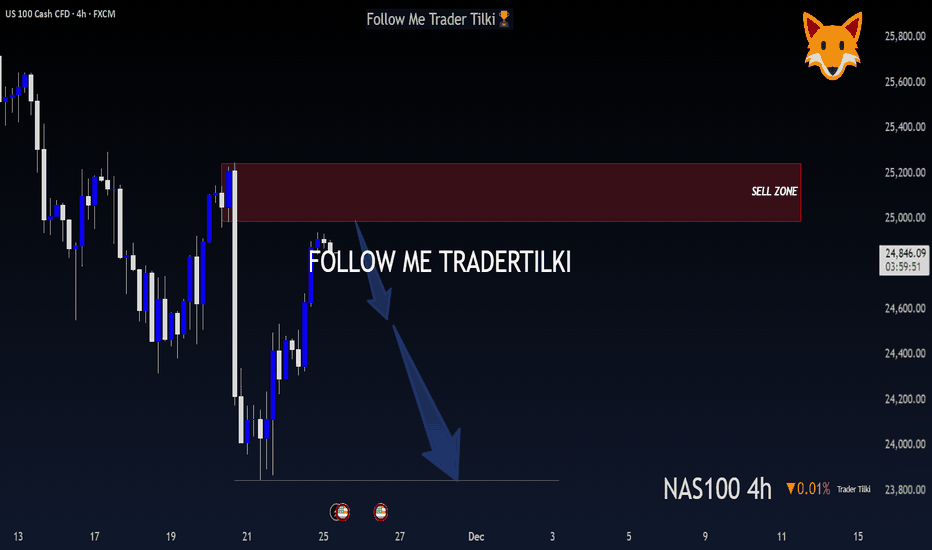

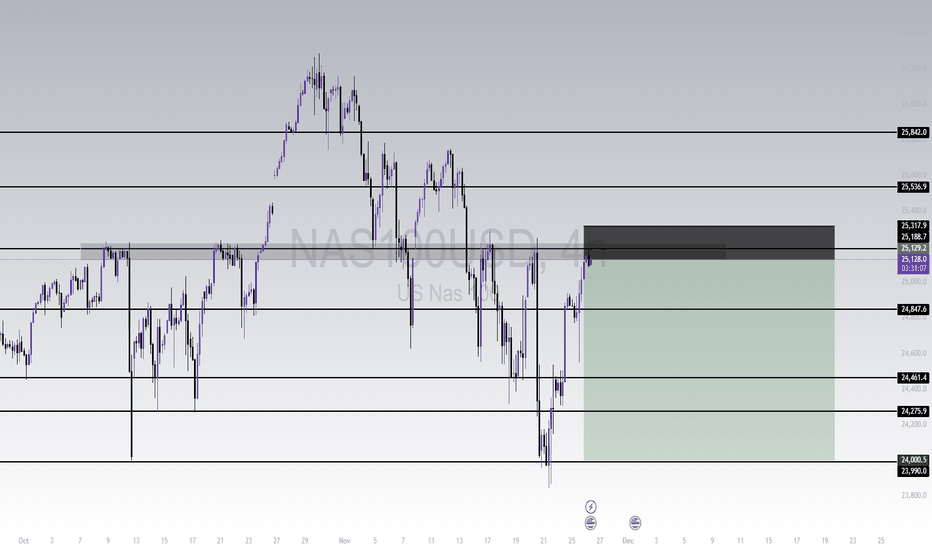

Market Hunter: NASDAQ-NAS100 Sell OpportunityMy friends, Good morning!☀️

For US100-NAS100, I will open a SELL position between 24,988 and 25,243, targeting 23,843.📊

My friends, I share these analyses thanks to every single like I receive from you.

Your likes increase my motivation and make me want to support you in this way.🙏

I sinc

About Nasdaq 100 Index

The NASDAQ-100 is an index that is constituted by 100 of the largest companies listed on the NASDAQ stock exchange, which is the second largest in the world only after the New York Stock Exchange by market capitalization. The companies that are listed in this index range from a variety of industries like Technology, Telecommunications, Biotechnology, Media, and Services. The NASDAQ-100 was first calculated in January 31 of 1985 by NASDAQ and it is a modified capitalization-weighted index. This index has been of good reference to investors that want to know how the stock market is performing without financial services companies, this given that the index excludes financial companies.

Related indices

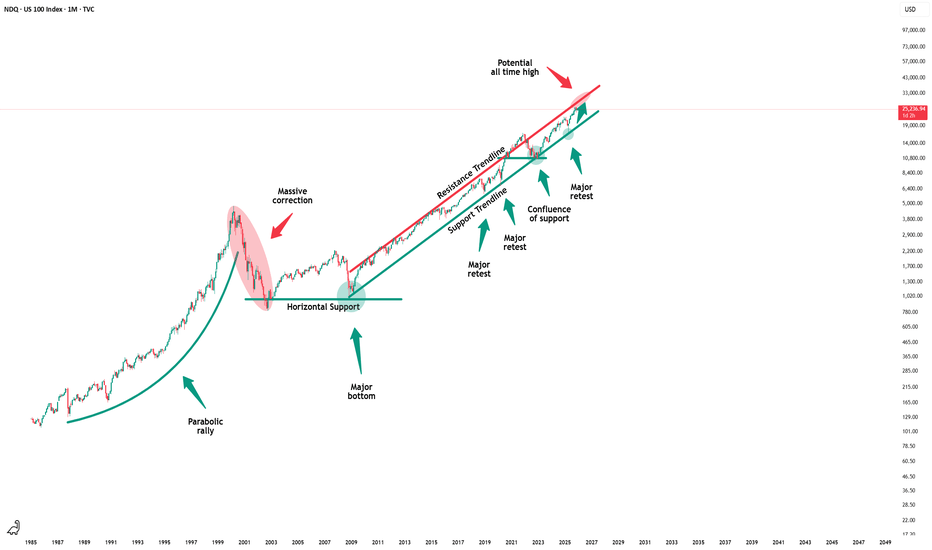

Nasdaq - The final blow-off top!⚰️Nasdaq ( TVC:NDQ ) can rally a final +25%:

🔎Analysis summary:

Just this month, we witnessed quite some volatility on the Nasdaq with a correction of about -10%. However, bulls immediately stepped in and clearly pushed price higher. Since there is still bullish pressure, a final blow-off top

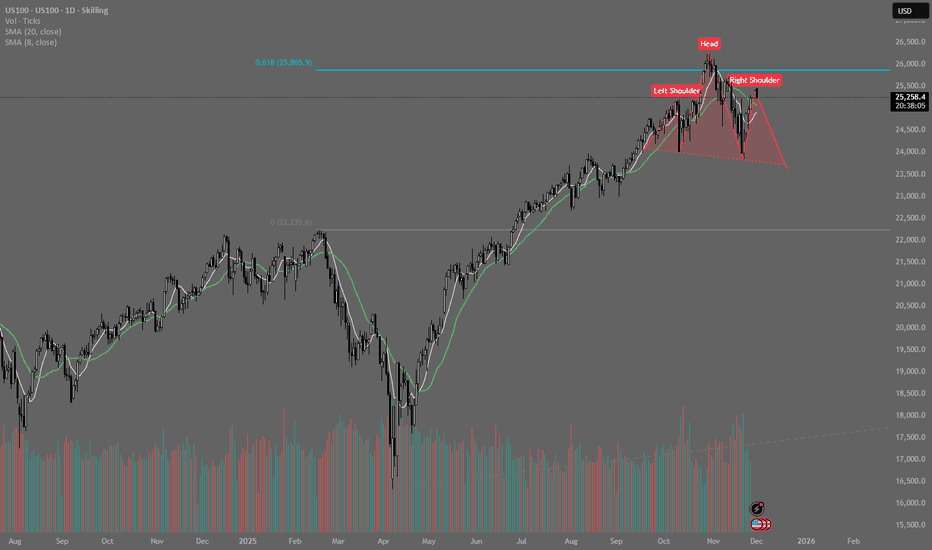

Tech bubble burst?The Head and Shoulders (H&S) pattern is a classic reversal formation, typically found after a mature uptrend. It represents a gradual loss of buying pressure and a transition toward a potential downward move.

The H&S pattern often signals the exhaustion of bullish momentum, a shift in control toward

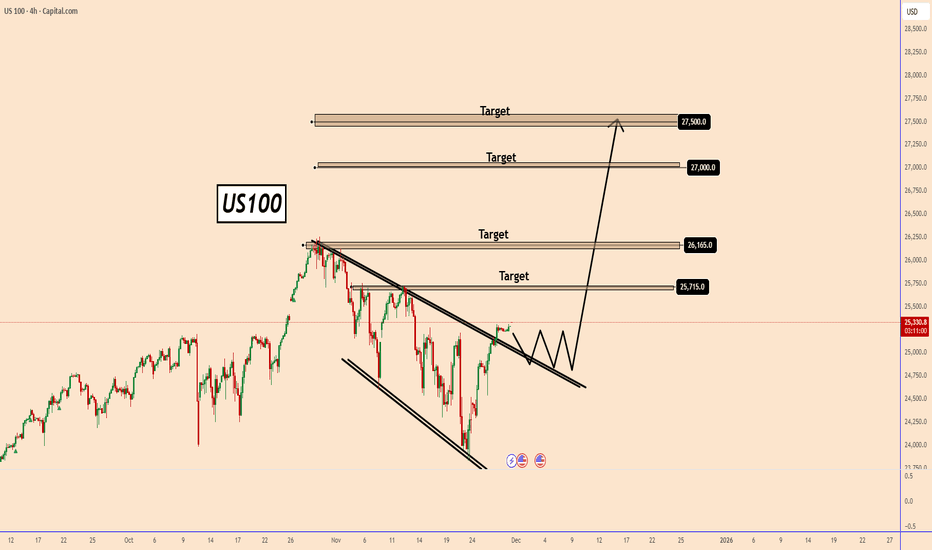

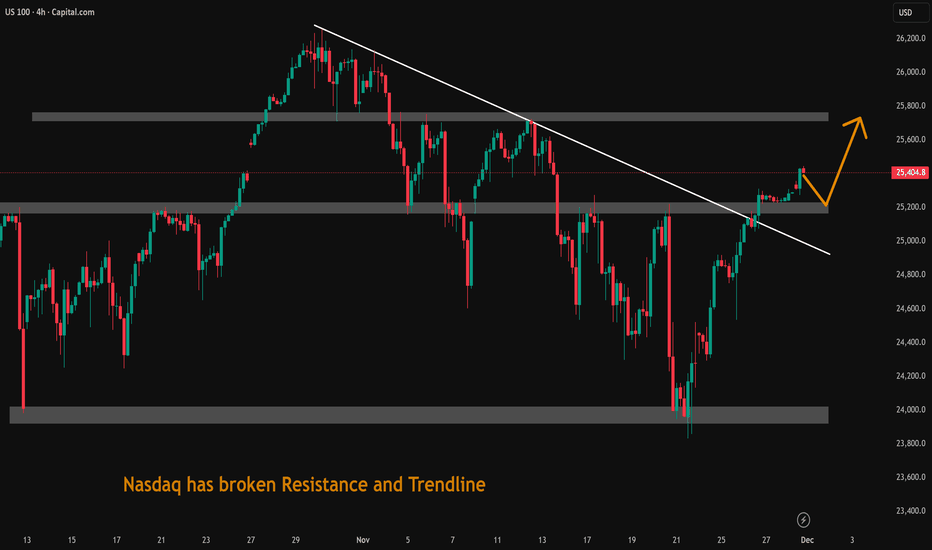

US100: Bullish Breakout Confirmed, But...US100: Bullish Breakout Confirmed, But a Healthy Pullback Is Needed

I would like to see a correction before buying US100

US100 has recently confirmed a Descending Broadening Wedge breakout, a pattern that typically signals the resumption of a strong bullish trend.

However, we are still in a low

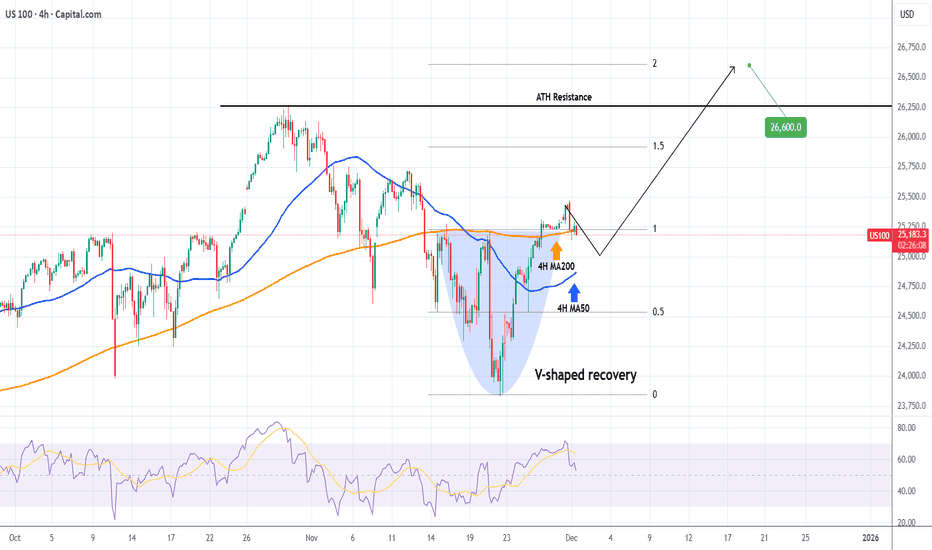

NASDAQ Santa Rally already underway.Nasdaq (NDX) has made a strong V-shaped recovery on its 1D MA100, as projected on our previous analysis and is extending the uptrend above the 4H MA200 (orange trend-line).

The rally may need a relief pull-back towards its 4H MA50 (blue trend-line) but technically, the seasonal end-of-the-year 'San

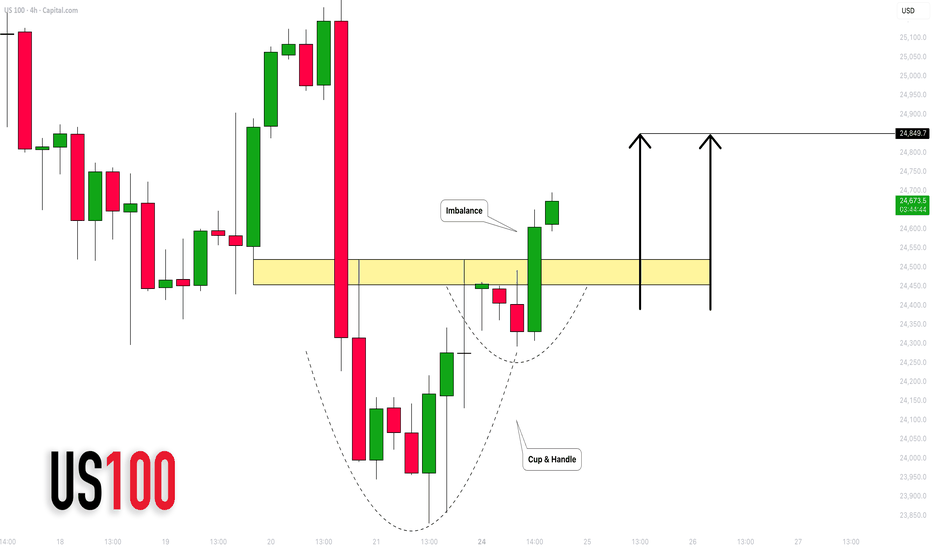

NASDAQ INDEX (US100): Strong Bullish Pattern

There is a high chance that US100 will rise

after a formation of a cup & handle pattern on a 4h time frame

with a breakout of its neckline with a bullish imbalance.

Expect a rise at least to 24850

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer progra

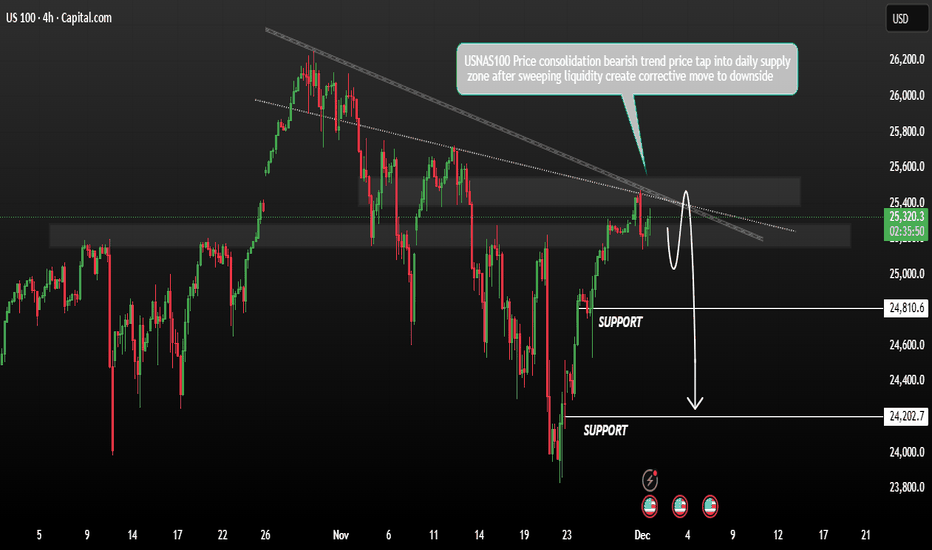

USNAS100 consolidating within a bearish trendThe USNAS100 is currently consolidating within a bearish trend. Wall Street’s main indexes are expected to open lower on Monday as investors move to the sidelines ahead of key economic data and a closely watched speech from Federal Reserve Chair Jerome Powell. Markets are looking for clues regarding

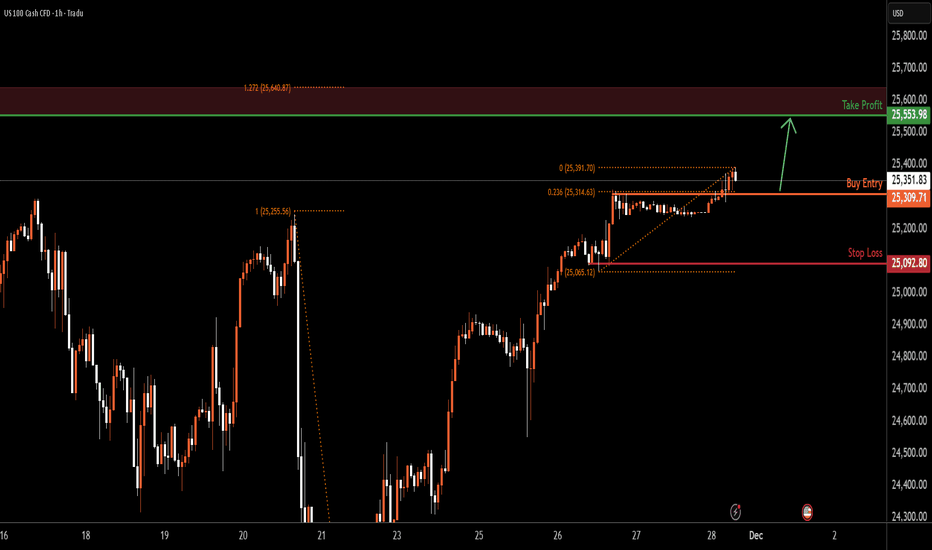

NAS100 | Bullish Bounce Off Pullback SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 25,308.70

- Pullback support

- 23.6% Fib retracement

Stop Loss: 25,092.80

- Multi-swing low support

Take Profit: 25,553.90

- Swing high resistance

- 127.2% Fib extension

High Risk Investment Warning

Stratos Markets Limite

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.