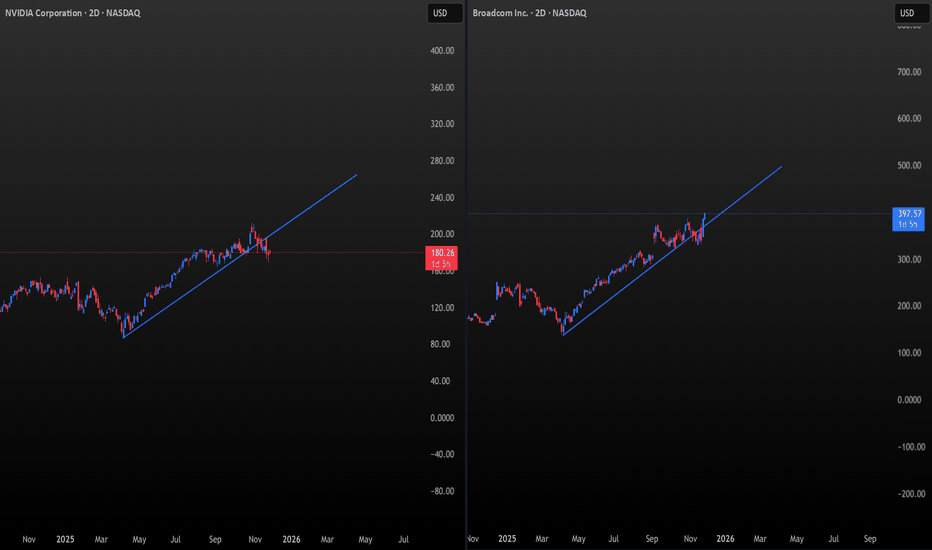

NVDA vs AVGO: The Battle for the AI Throne Has Begun⚡A New Leader Emerges in the Semiconductors

For years, NVDA was the undisputed titan — the gravitational center of the semiconductor universe.

But now, the geometry tells a different story.

THE CHARTS 📐

Both charts use the same natural scaling:

1° of time = $1 of price per unit.

And here’s the

Key facts today

Nvidia invested $2 billion in Synopsys, buying shares at $414.79 each. This deal aims to boost AI and chip design efficiency, leading to a 3% stock rise for Nvidia.

Amazon Web Services will use Nvidia's NVLink Fusion tech in future AI chips, enhancing connections for larger servers and faster communication, crucial for training extensive AI models.

Nvidia's CFO confirmed that negotiations for a $100 billion deal with OpenAI are ongoing. The deal involves deploying 10 gigawatts of Nvidia systems, separate from $500 billion in existing bookings.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.07 USD

72.88 B USD

130.50 B USD

23.31 B

About NVIDIA Corporation

Sector

Industry

CEO

Jen Hsun Huang

Website

Headquarters

Santa Clara

Founded

1993

ISIN

US67066G1040

FIGI

BBG000BBJQV0

IPO date

Jan 22, 1999

IPO offer price

12.00 USD

NVIDIA Corp engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software. It operates through the following segments: Graphics Processing Unit (GPU), Tegra Processor, and All Other. The GPU segment comprises of product brands, which aims specialized markets including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users. The Tegra Processor segment integrates an entire computer onto a single chip, and incorporates GPUs and multi-core CPUs to drive supercomputing for autonomous robots, drones, and cars, as well as for consoles and mobile gaming and entertainment devices. The All Other segment refers to the stock-based compensation expense, corporate infrastructure and support costs, acquisition-related costs, legal settlement costs, and other non-recurring charges. The company was founded by Jen Hsun Huang, Chris A. Malachowsky, and Curtis R. Priem in January 1993 and is headquartered in Santa Clara, CA.

Related stocks

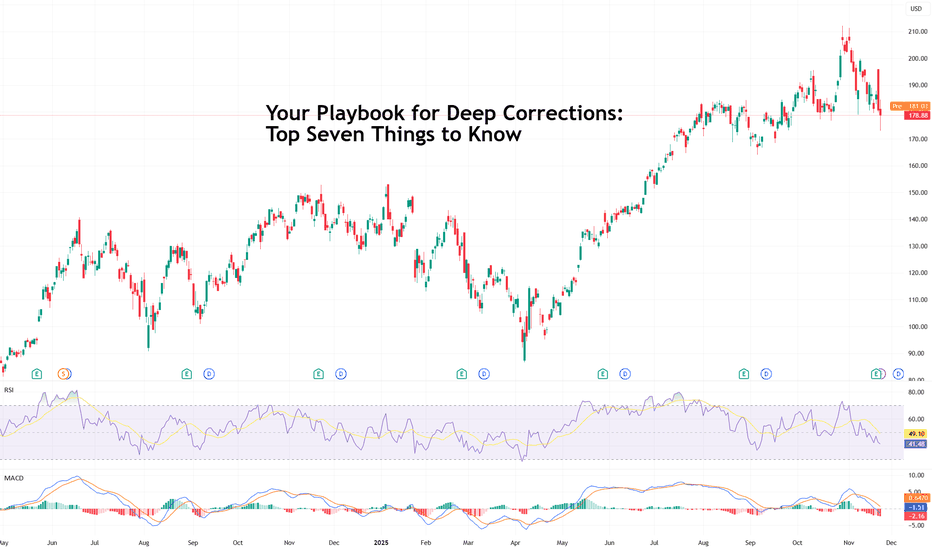

Your Playbook for Deep Corrections: Top Seven Things to KnowEvery trader hopes that whatever is happening with any pullback is healthy. “Just a healthy retreat, it’ll go back, it always does. R-r-right?”

While that’s true (obviously, markets had always shot up to records after deep losses), your job is to survive that lower leg and ideally come out stronger

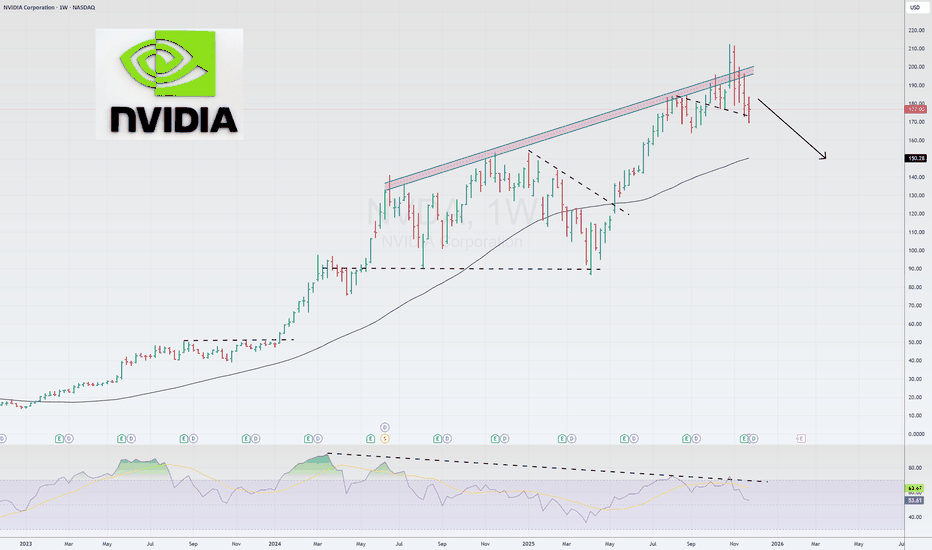

Nvidia - The correction just started!💉Nvidia ( NASDAQ:NVDA ) is now heading lower:

🔎Analysis summary:

Just recently, Nvidia once again retested the major rising channel resistance trendline. Together with November's bearish engulfing candle, Nvidia is slowly shifting bearish. And before Nvidia will retest the next major support

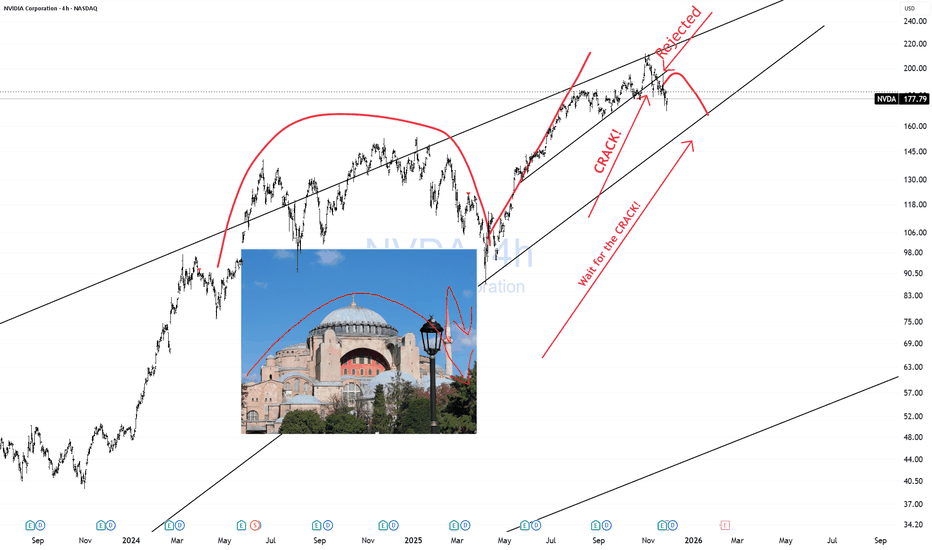

NVDA Hagia Sophia CRACKING! CAUTION!NVDA is starting to fall apart. Nice rounding top followed by mini towerspike (as shown in the picture) that is now starting to roll over.

The price was rejected after the first crack that bounced lower. That's the big warning CRACK! Now we wait for the bigger CRACK! to occur.

Despite how small i

NVDA🌎NVIDIA: At the Peak or the Brink?

Nvidia's record highs are accompanied by warning signs. A market cap of $4.37 trillion and a P/E ratio of 51 indicate inflated expectations.

Risks:

Speculative demand: The $23.7 billion investment looks like an artificial market pump.

Macro threats: The AI bo

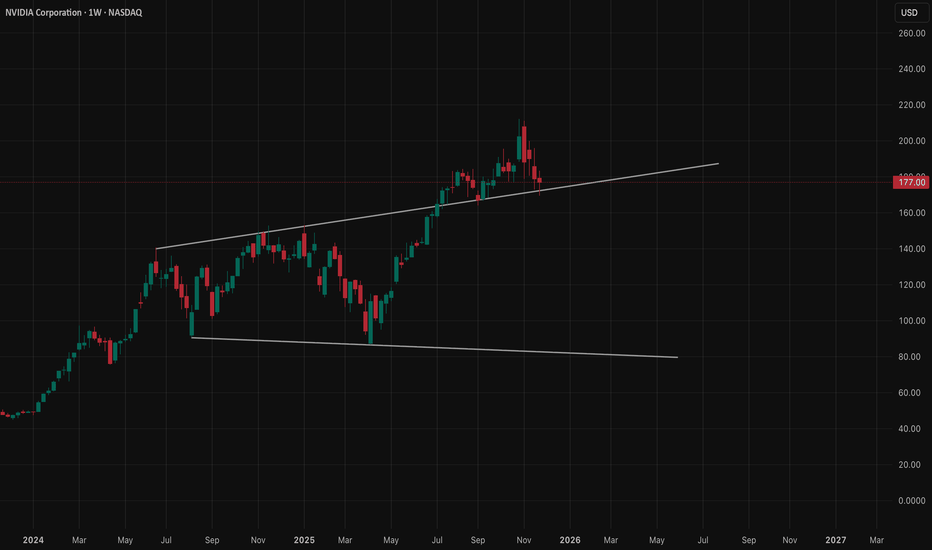

Nvidia - Now is the time to go short!💣Nvidia ( NASDAQ:NVDA ) is now creating a top:

🔎Analysis summary:

Just a couple of days ago, Nvidia perfectly retested a major resistance trendline. Always in the past, such a retest was followed by a major move towards the downside. Therefore, Nvidia is preparing for a major drop, which coul

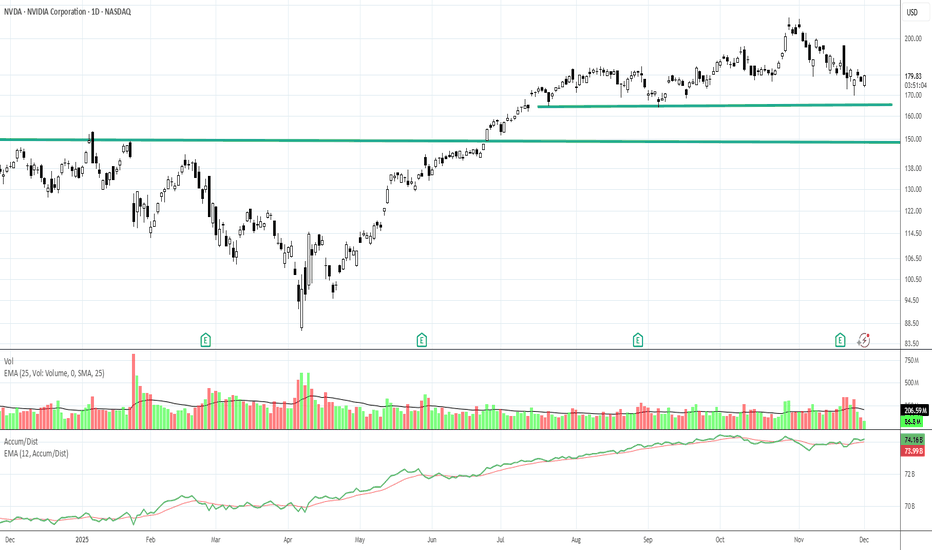

NVDA at a Decision Level – Dec 1–5 OutlookWeekly – Trend Still Up, But Losing Strength

NVDA has been riding a strong multi-month uptrend, but the last few weekly candles show the first real slowdown. A clear CHoCH formed near the recent highs, and sellers stepped in aggressively. The weekly candle closed with a long upper wick and a heavier

Market Conditions are the Cycle of a Bull or Bear MarketEverything you are learning is beneficial to your trading so long as the information is factual and accurate and NOT hype, scams, fraud, misinformation or manipulative information.

One way to determine if what you are learning is accurate or not is to understand the CYCLEs of the Bull Market and Bea

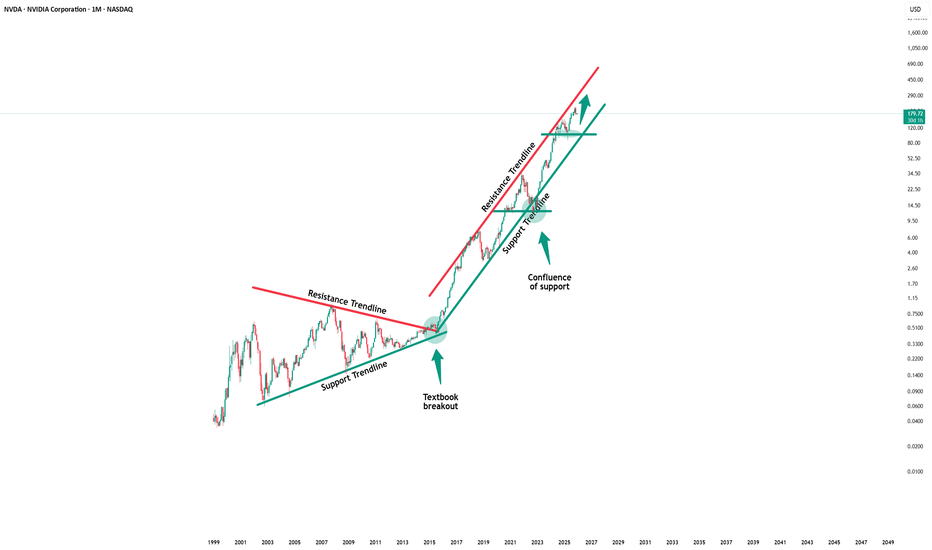

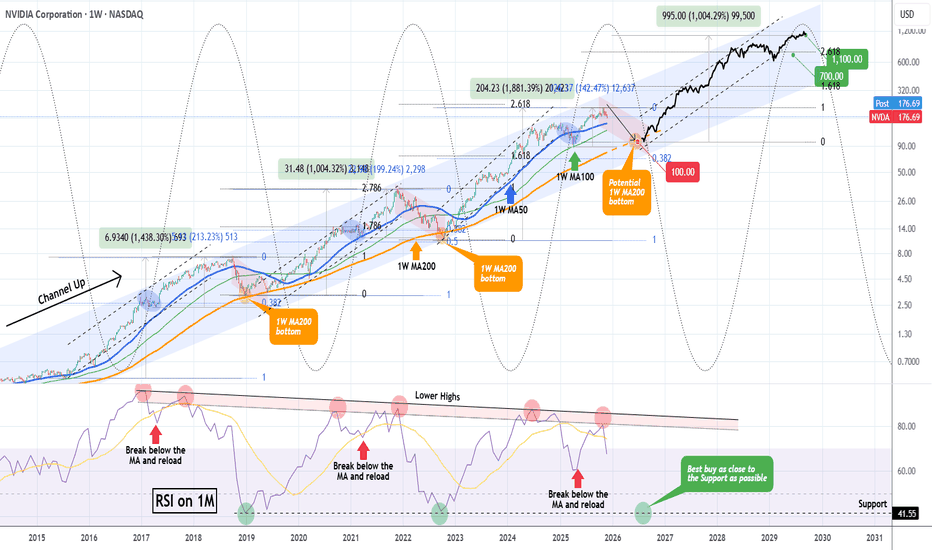

NVIDIA Trading plan from $100 to $1000. Is it plausible?Exactly a month ago, we called the end of the rally on NVIDIA Corporation (NVDA), essentially the end of its multi-year Bull Cycle and the beginning of an aggressive Bear Cycle correction.

** The 10 year Channel Up **

So far this is paying dividends as the stock just completed a 4-week red streak

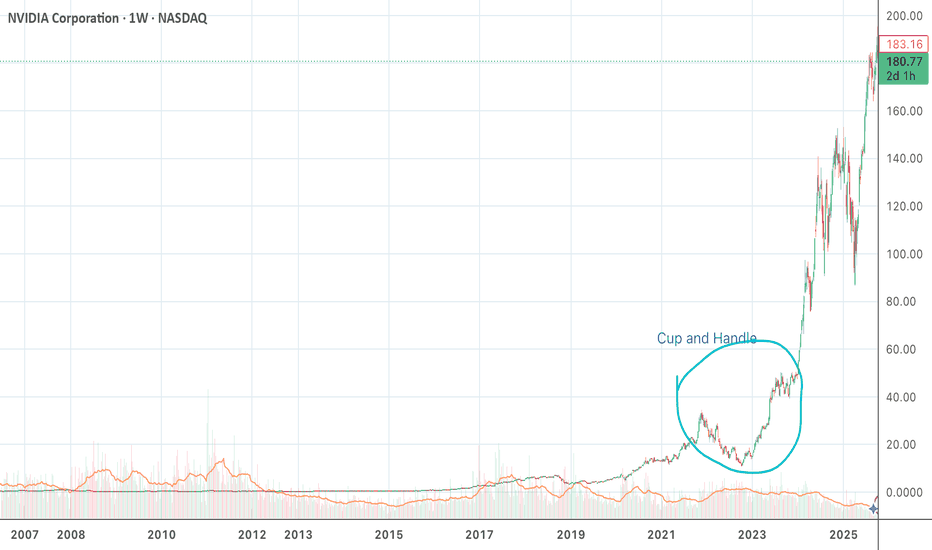

NVIDIA Cup and HandleThe cup and handle is a bullish continuation pattern in technical analysis that signals a potential uptrend after a period of consolidation.

It consists of two parts: a rounded, "U-shaped" cup, and a smaller, downward-sloping handle that forms on the right side of the cup.

Traders look for a bre

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NVDA4971919

NVIDIA Corporation 3.7% 01-APR-2060Yield to maturity

5.29%

Maturity date

Apr 1, 2060

NVDA4971918

NVIDIA Corporation 3.5% 01-APR-2050Yield to maturity

5.27%

Maturity date

Apr 1, 2050

NVDA4971917

NVIDIA Corporation 3.5% 01-APR-2040Yield to maturity

4.88%

Maturity date

Apr 1, 2040

US67066GAN4

NVIDIA Corporation 2.0% 15-JUN-2031Yield to maturity

4.03%

Maturity date

Jun 15, 2031

US67066GAE4

NVIDIA Corporation 3.2% 16-SEP-2026Yield to maturity

3.96%

Maturity date

Sep 16, 2026

NVDA4971916

NVIDIA Corporation 2.85% 01-APR-2030Yield to maturity

3.95%

Maturity date

Apr 1, 2030

NVDA5203204

NVIDIA Corporation 1.55% 15-JUN-2028Yield to maturity

3.65%

Maturity date

Jun 15, 2028

See all NVDA bonds

Curated watchlists where NVDA is featured.

Frequently Asked Questions

The current price of NVDA is 181.46 USD — it has increased by 1.65% in the past 24 hours. Watch NVIDIA Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange NVIDIA Corporation stocks are traded under the ticker NVDA.

NVDA stock has risen by 0.24% compared to the previous week, the month change is a −12.85% fall, over the last year NVIDIA Corporation has showed a 30.71% increase.

We've gathered analysts' opinions on NVIDIA Corporation future price: according to them, NVDA price has a max estimate of 432.78 USD and a min estimate of 140.00 USD. Watch NVDA chart and read a more detailed NVIDIA Corporation stock forecast: see what analysts think of NVIDIA Corporation and suggest that you do with its stocks.

NVDA reached its all-time high on Oct 29, 2025 with the price of 212.19 USD, and its all-time low was 0.03 USD and was reached on Apr 26, 1999. View more price dynamics on NVDA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NVDA stock is 3.19% volatile and has beta coefficient of 1.90. Track NVIDIA Corporation stock price on the chart and check out the list of the most volatile stocks — is NVIDIA Corporation there?

Today NVIDIA Corporation has the market capitalization of 4.37 T, it has decreased by −3.04% over the last week.

Yes, you can track NVIDIA Corporation financials in yearly and quarterly reports right on TradingView.

NVIDIA Corporation is going to release the next earnings report on Feb 12, 2026. Keep track of upcoming events with our Earnings Calendar.

NVDA earnings for the last quarter are 1.30 USD per share, whereas the estimation was 1.26 USD resulting in a 3.22% surprise. The estimated earnings for the next quarter are 1.51 USD per share. See more details about NVIDIA Corporation earnings.

NVIDIA Corporation revenue for the last quarter amounts to 57.01 B USD, despite the estimated figure of 54.91 B USD. In the next quarter, revenue is expected to reach 65.14 B USD.

NVDA net income for the last quarter is 31.91 B USD, while the quarter before that showed 26.42 B USD of net income which accounts for 20.77% change. Track more NVIDIA Corporation financial stats to get the full picture.

Yes, NVDA dividends are paid quarterly. The last dividend per share was 0.01 USD. As of today, Dividend Yield (TTM)% is 0.02%. Tracking NVIDIA Corporation dividends might help you take more informed decisions.

NVIDIA Corporation dividend yield was 0.02% in 2024, and payout ratio reached 1.16%. The year before the numbers were 0.03% and 1.34% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 3, 2025, the company has 36 K employees. See our rating of the largest employees — is NVIDIA Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NVIDIA Corporation EBITDA is 112.70 B USD, and current EBITDA margin is 63.85%. See more stats in NVIDIA Corporation financial statements.

Like other stocks, NVDA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NVIDIA Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NVIDIA Corporation technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NVIDIA Corporation stock shows the buy signal. See more of NVIDIA Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.