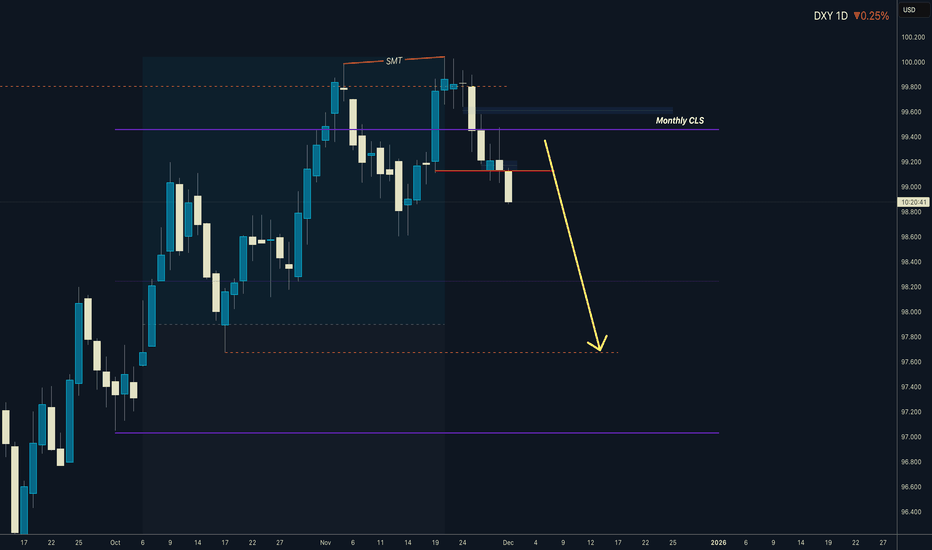

DXY I Monthly CLS range - Model 1- TP discount LQHi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

About U.S. Dollar Index

The U.S. Dollar Index tracks the strength of the dollar against a basket of major currencies. DXY was originally developed by the U.S. Federal Reserve in 1973 to provide an external bilateral trade-weighted average value of the U.S. dollar against global currencies. U.S. Dollar Index goes up when the U.S. dollar gains "strength" (value), compared to other currencies. The following six currencies are used to calculate the index:

Euro (EUR) 57.6% weight

Japanese yen (JPY) 13.6% weight

Pound sterling (GBP) 11.9% weight

Canadian dollar (CAD) 9.1% weight

Swedish krona (SEK) 4.2% weight

Swiss franc (CHF) 3.6% weight

Euro (EUR) 57.6% weight

Japanese yen (JPY) 13.6% weight

Pound sterling (GBP) 11.9% weight

Canadian dollar (CAD) 9.1% weight

Swedish krona (SEK) 4.2% weight

Swiss franc (CHF) 3.6% weight

Related indices

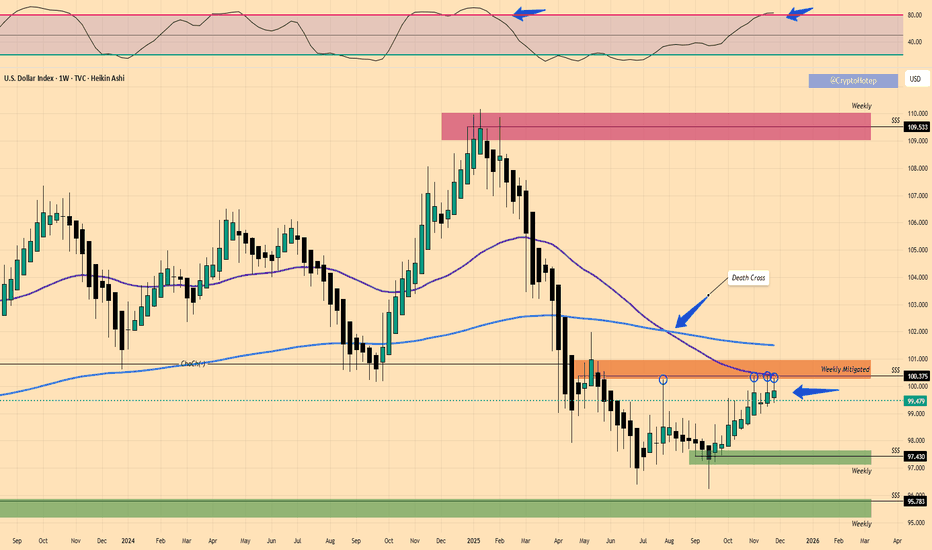

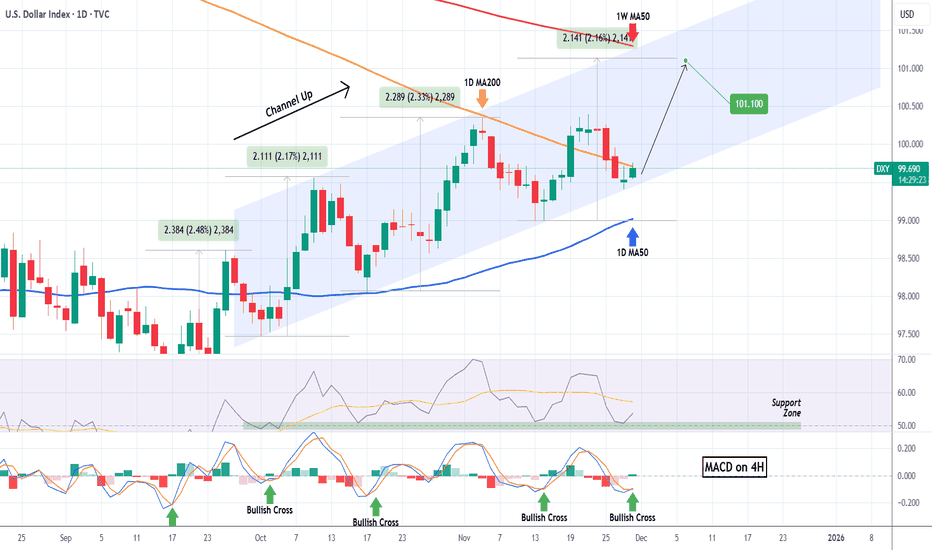

DXY bottomed and is starting the new Bullish Leg.The U.S. Dollar index (DXY) has been trading within a Channel Up since the October 01 Low last week even broke above its 1D MA200 (orange trend-line) for the first time since March 05 2025.

Technically, that is confirmation for the long-term continuation of the uptrend. As long as the 1D MA50 (blue

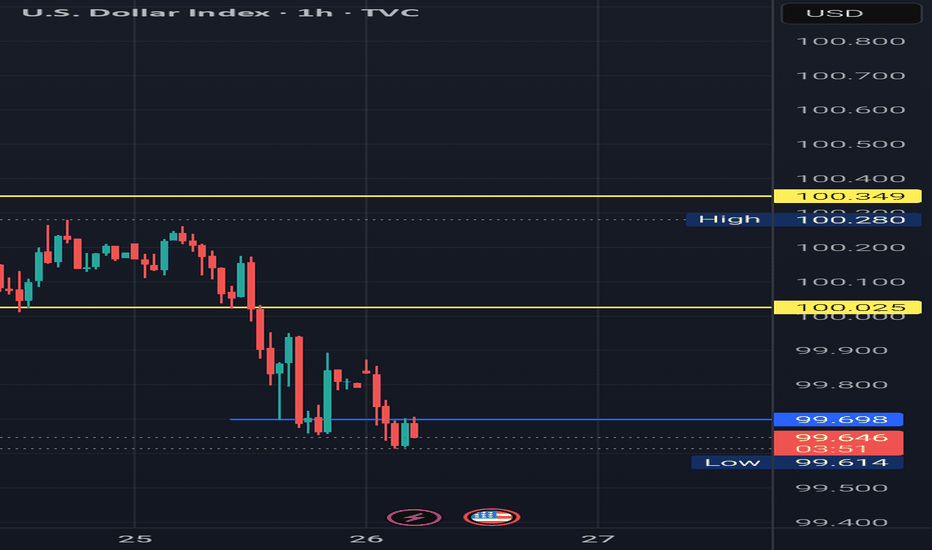

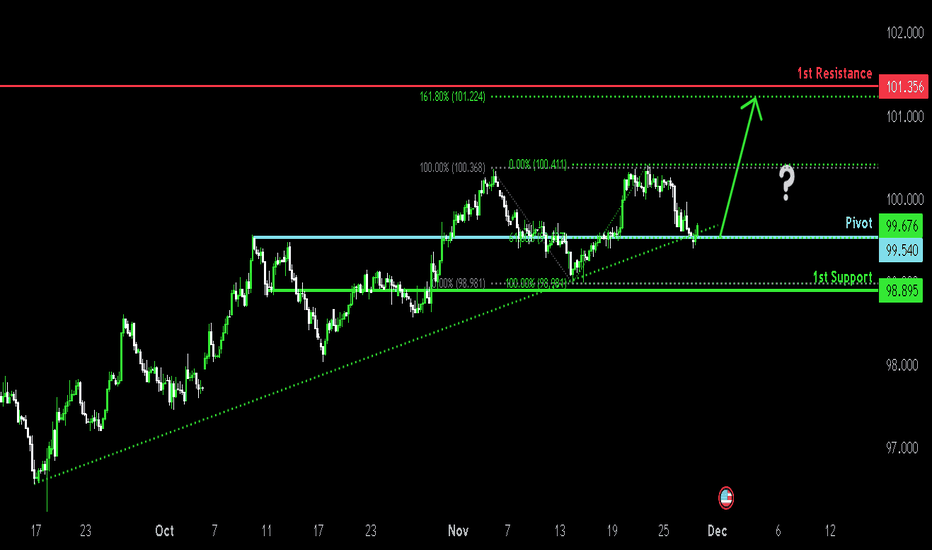

Bullish bounce off?US Dollar Index (DXY) is reacting off the pivot, which acts as a pullback support and could bounce to the 1st resistance.

Pivot: 99.54

1st Support: 98.89

1st Resistance: 101.35

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice

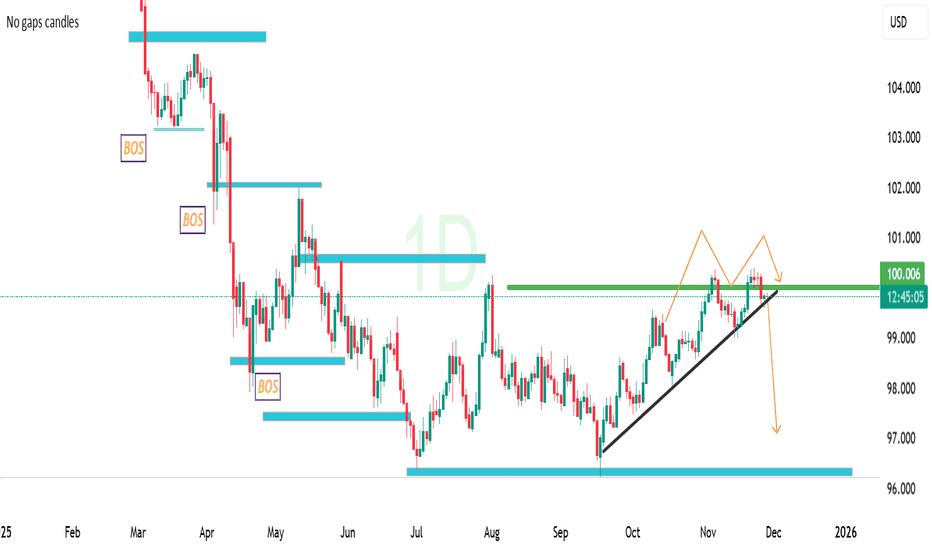

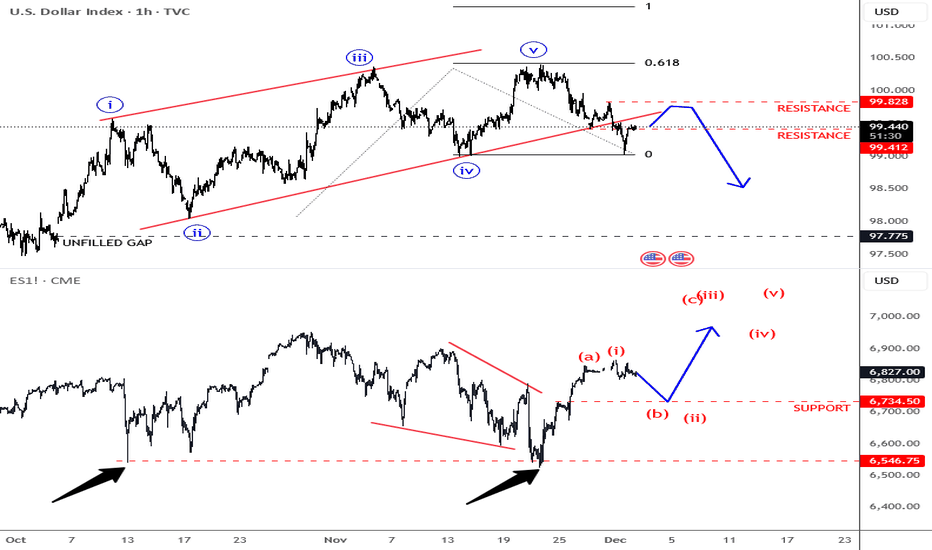

Dollar Breaks The Wedge Support As SP500 Eyeing More UpsideHey guy, hope everyone is doing well.

As you know, we have seen some minor pullback on stocks yesterday as JPY come up a bit, after some hawkish remarks from BOJ Ueda. And at the same time cryptocurrencies also experienced a pretty sharp sell-off. But I believe these are all just temporary flows a

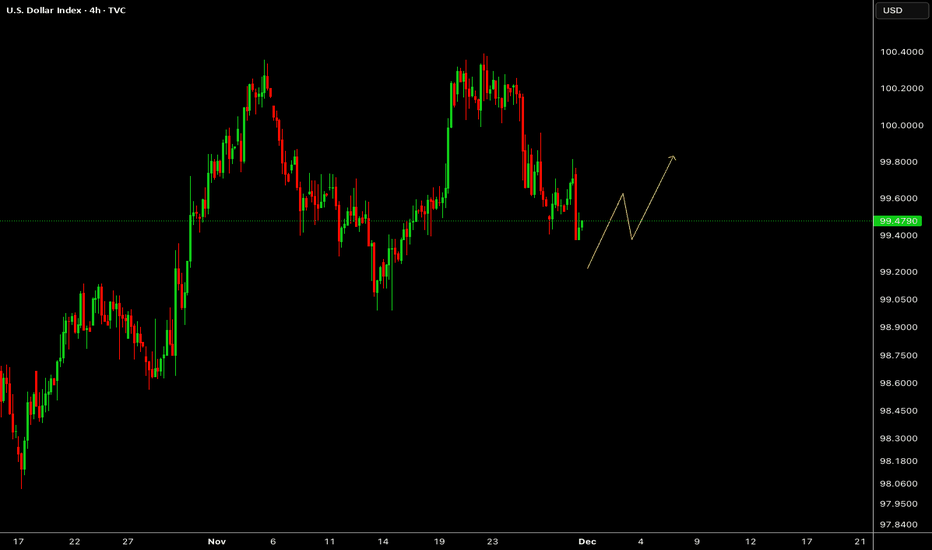

DXY: Dollar Index Mid-Term OutlookThe U.S. Dollar Index is maintaining a steady corrective rhythm on the 4-hour timeframe, with recent price behaviour indicating a potential shift in momentum as markets transition into December. Current swings highlight an evolving structure where buyers and sellers continue to balance out ahead of

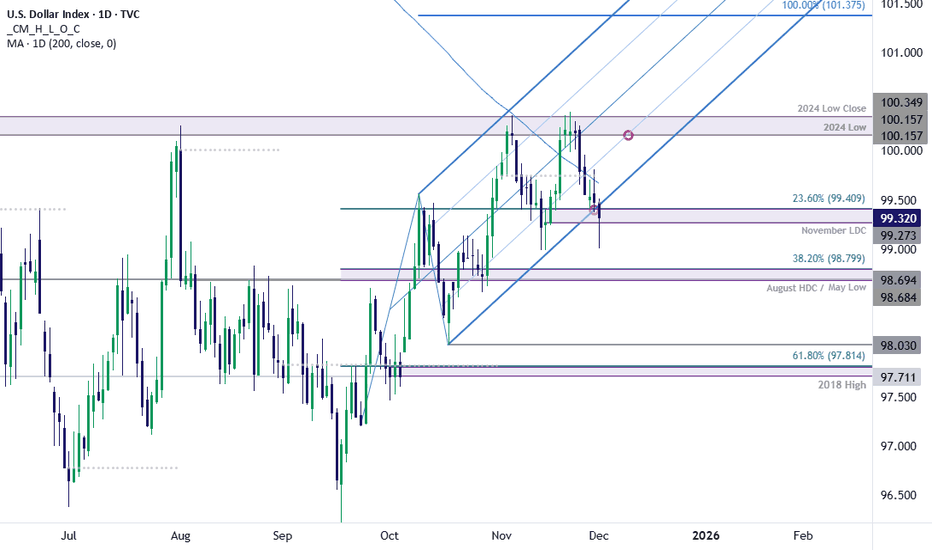

US Dollar Plunges into December as DXY Threatens September RallyThe US Dollar plunged more than 1.3% off the November highs after DXY turned from pivotal resistance last week at 100.15/35- a region defined by the 2024 low, the August high, and the 2024 low-close. The losses are now threatening to break the September uptrend, and the focus is on today’s close wit

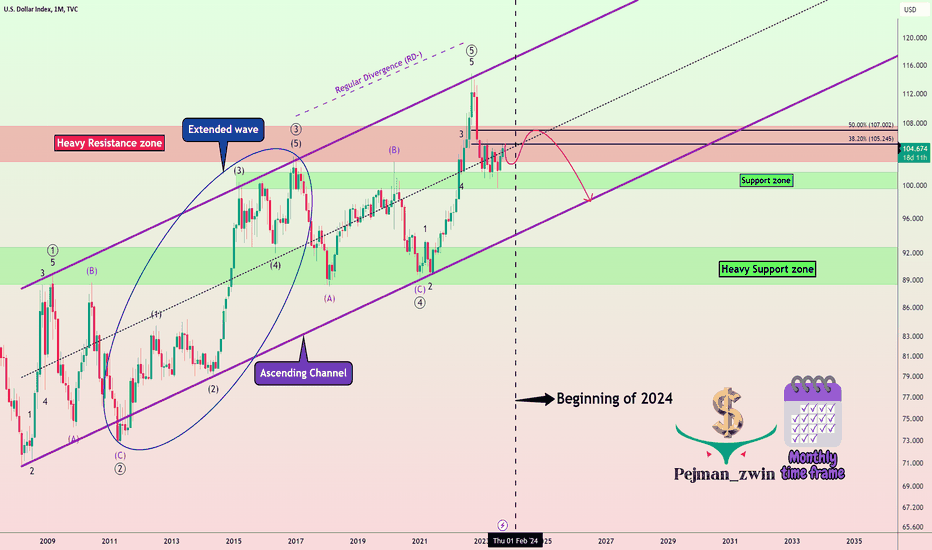

What should we expect from DXY Index by the end of 2023❗️❓🗺️👋Hi everyone (Reading time less than 3 minutes⏰) .

📚One of the most important Indices that we should have an analysis of is the DXY index because it has a direct impact on the Forex , Cryptocurrency , and stock and etc markets. So, in this post, I'm going to show you the 🗺️ Roadmap 🗺️ for DX

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of U.S. Dollar Index is 99.157 USD — it has risen by 0.08% in the past 24 hours. Track the index more closely on the U.S. Dollar Index chart.

U.S. Dollar Index reached its highest quote on Feb 25, 1985 — 164.720 USD. See more data on the U.S. Dollar Index chart.

The lowest ever quote of U.S. Dollar Index is 70.698 USD. It was reached on Mar 17, 2008. See more data on the U.S. Dollar Index chart.

U.S. Dollar Index value has decreased by −0.72% in the past week, since last month it has shown a −0.01% decrease, and over the year it's decreased by −6.87%. Keep track of all changes on the U.S. Dollar Index chart.

U.S. Dollar Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy U.S. Dollar Index futures or funds or invest in its components.