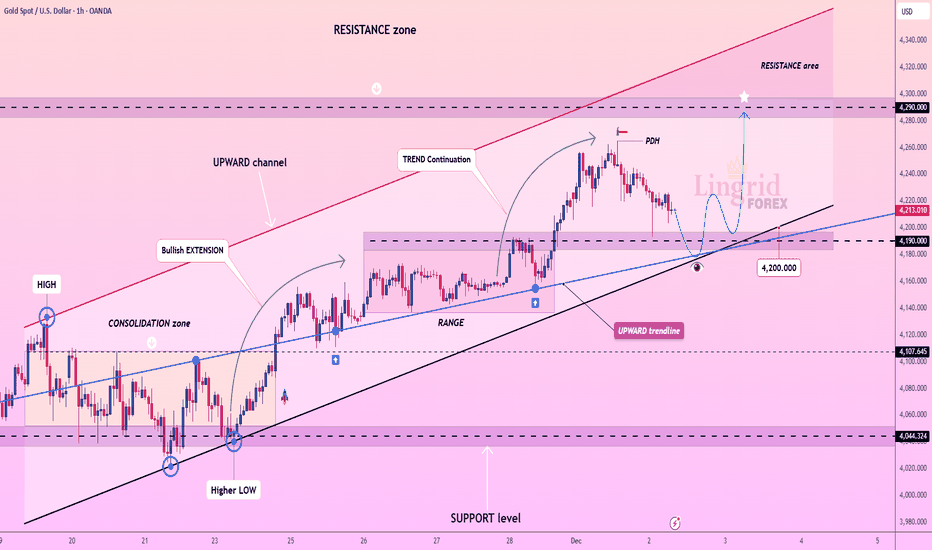

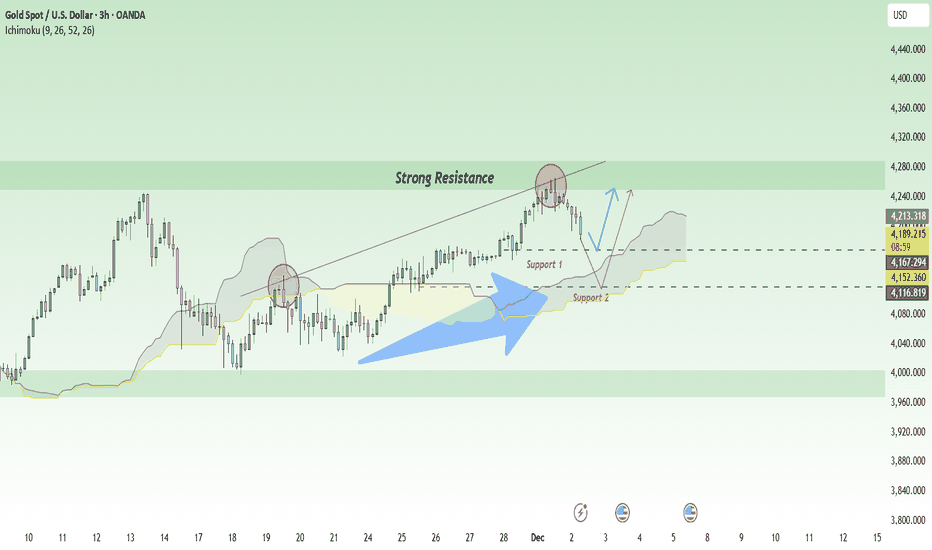

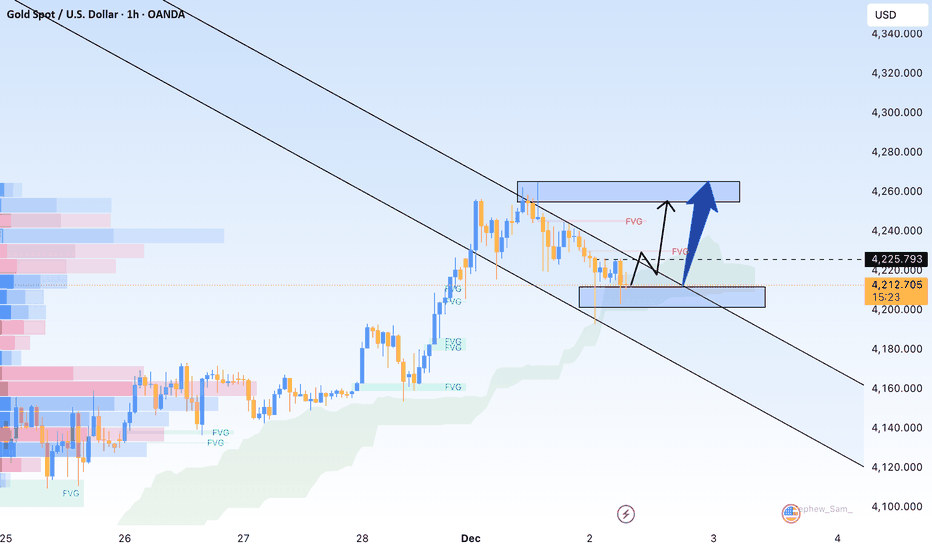

Lingrid | GOLD Pullback Trading Opportunity from Support ZoneOANDA:XAUUSD is retracing into the 4,190–4,200 support band after an extended bullish run within the upward channel. The broader structure remains firmly bullish, with higher lows and higher highs forming along the rising trendline and each dip being absorbed by buyers. Price is now testing zone below the previous-day low, creating a classic buy pullback setup inside a continuation trend.

If TVC:GOLD stabilizes above the trendline and reclaims intraday momentum, the next upside rotation could drive the metal toward the 4,290 resistance shelf, aligned with the higher boundary of the channel. Maintaining support above 4,190 keeps the bullish sequence intact and favors further acceleration.

➡️ Primary scenario: pullback holds above 4,190 → continuation toward 4,290.

⚠️ Risk scenario: a clean break below channel exposes 4,100 and delays bullish continuation.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Futures market

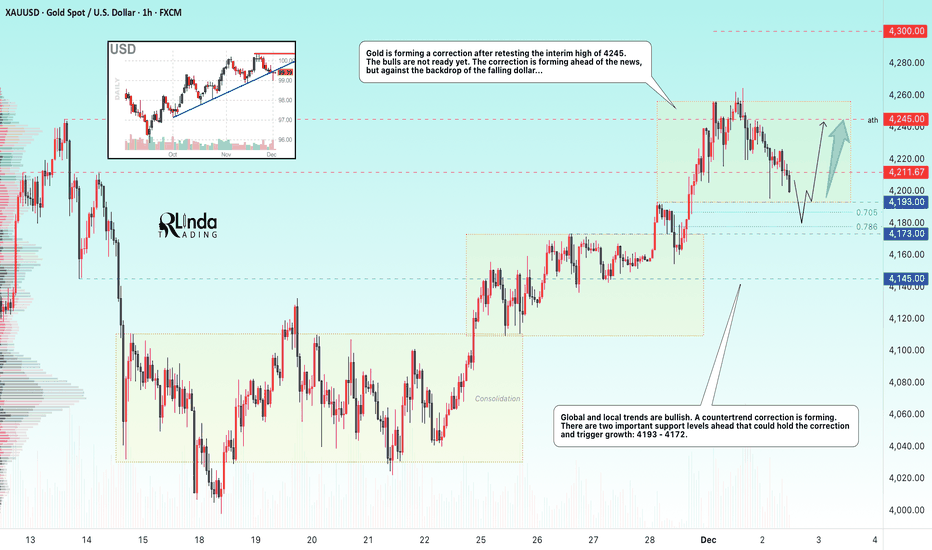

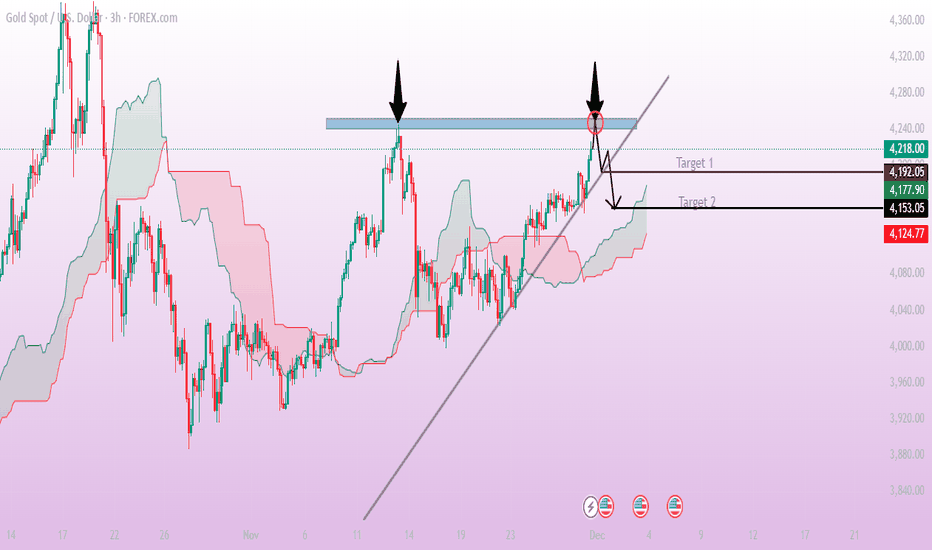

GOLD → Correction to support amid a bullish trend FX:XAUUSD retreated from the $4,245 level reached on Monday. A countertrend correction is forming ahead of the news. But buyers are not sleeping...

Weak US economic data has heightened expectations of an imminent Fed rate cut. The PMI index in the US manufacturing sector continued to contract. The market estimates the probability of the Fed easing policy next week at 87%.

However, rising US Treasury yields and fears that the Fed may send cautious signals after its December decision are limiting gold's growth.

Market attention is shifting to ADP employment data and the US services business activity index (ISM Services PMI), which will be released on Wednesday. They will provide new signals about the health of the US economy.

The correction in gold appears to be under control amid continuing macroeconomic uncertainty. The 4200, 4193-4173 level remains an important area of struggle between bulls and bears.

Resistance levels: 4211, 4245

Support levels: 4193, 4173

A false breakdown and the bulls holding the market above the above support zone could trigger growth within the trend.

Best regards, R. Linda!

Gold H1 – Will 4278–4280 Trigger a Drop Into 4170 Today?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (01/12)

📈 Market Context

Gold continues its impressive rally as markets price in a potential rate cut by the Federal Reserve (Fed) in December. Spot gold recently surged past $4,230/oz — hitting a multi-week high — as the US Dollar Index (DXY) weakened.

The backdrop is increasingly dovish: fading USD strength, soft U.S. macro data, and dovish comments from Fed officials have fueled speculative buying in gold.

Technically, gold remains elevated, hovering inside a rising channel — similar to what’s shown on your chart. Price compression following strong displacement suggests a consolidation before the next institutional move.

🔎 Technical Framework – Smart Money Structure (H1)

Current state = Accumulation / Distribution within rising channel

Liquidity zones & key triggers

• Premium liquidity zone (sell-opportunity): ~ 4278–4280 (near upper channel resistance) — aligns with your SELL zone.

• Discount liquidity zone (buy-origin / re-entry zone): ~ 4172–4170 (near lower channel support / trendline) — aligns with your BUY zone.

• Equilibrium / chop zone: mid-channel / recent consolidation zone — avoid trading blindly here unless structure breaks.

Expected Smart Money sequence

Sweep → CHoCH/MSS → BOS → Displacement → Retest (FVG/OB) → Expansion

Given the macro tailwinds (weak USD, rate-cut odds), gold remains primed for a directional move once structure confirms.

🎯 Trade Plans for Today

🔴 SELL GOLD 4278 – 4280 | SL 4288

• Thesis: A liquidity sweep at channel top / premium zone followed by engineered bearish displacement — capturing liquidity before a reversal.

• Entry rules (must wait for confirmation):

• Price touches 4280 zone

• Bearish CHoCH / MSS + BOS down on M5–M15

• Entry ideally on FVG fill or after order-block retest post-BOS

• Targets:

1. 4245 – 4240 area (first reaction)

2. 4225 – 4215 (mid-channel retest)

3. 4175 – 4172 (lower channel + buy zone)

🟢 BUY GOLD 4172 – 4170 | SL 4162

• Thesis: Discount-origin tap near lower channel support / trendline — smart money likely to accumulate for next leg up, especially amid dovish Fed sentiment.

• Entry rules (must wait for confirmation):

• Price dips into 4170 zone

• Bullish CHoCH / MSS + BOS up on M5–M15

• Strong bullish wick + FVG fill or OB retest confirmation

• Targets:

1. 4225 – 4230 (first reaction / mid-channel)

2. 4255 – 4265 (upper mid-channel)

3. 4278 – 4280+ (premium liquidity retest)

⚠️ Risk Management & Notes

• Avoid trading inside the mid-channel chop zone without structural confirmation — no “blind” entries.

• Do not treat sweeps (top or bottom) as trend entries — these are often traps.

• Use tight SL (structure invalidation), avoid averaging in consolidation.

• Given potential volatility from macro headlines or a USD bounce, consider reducing lot size.

Summary

Gold is currently riding macro tailwinds — weak USD + Fed rate-cut odds — but from a technical perspective, it’s compressed inside a rising channel. The day’s price action may be a classic Smart Money liquidity hunt: either a sweep at 4278–4280 leading to a sharp drop toward 4170, or a retracement to 4170 that sets up a fresh bull leg.

Only trade after structural confirmation (CHoCH / BOS + retest) — avoid “trend-hop” entries.

📍 Follow @Ryan_TitanTrader for daily Smart Money updates.

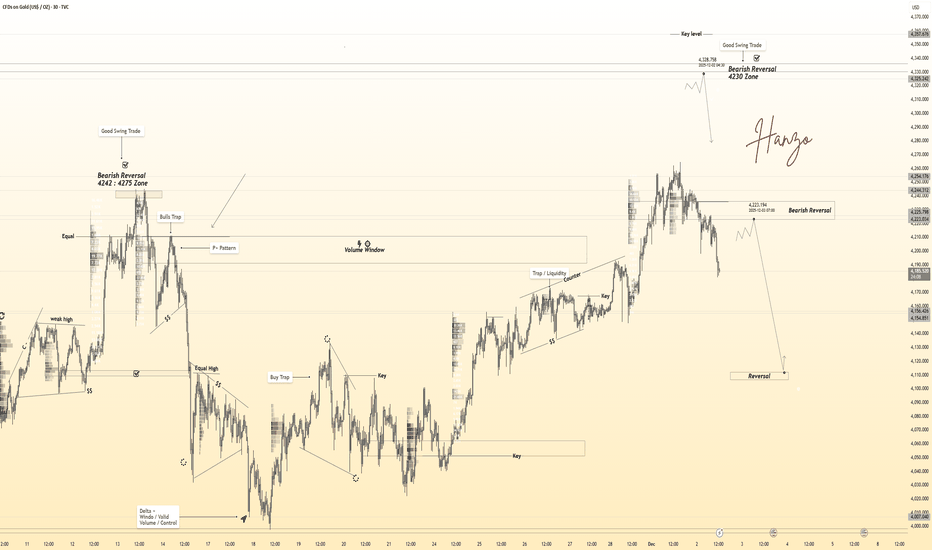

Gold 30-Min — Volume Sell Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — SHORT / Reversal 4222 Area

☄️Bearish rejection confirmed through sharp candle body.

☄️Lower-high forming beneath resistance supply region.

☄️Volume decreasing confirms exhaustion in price rally.

☄️Sellers regained imbalance with heavy top rejection.

☄️Algorithm detects fading demand and shift to control.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

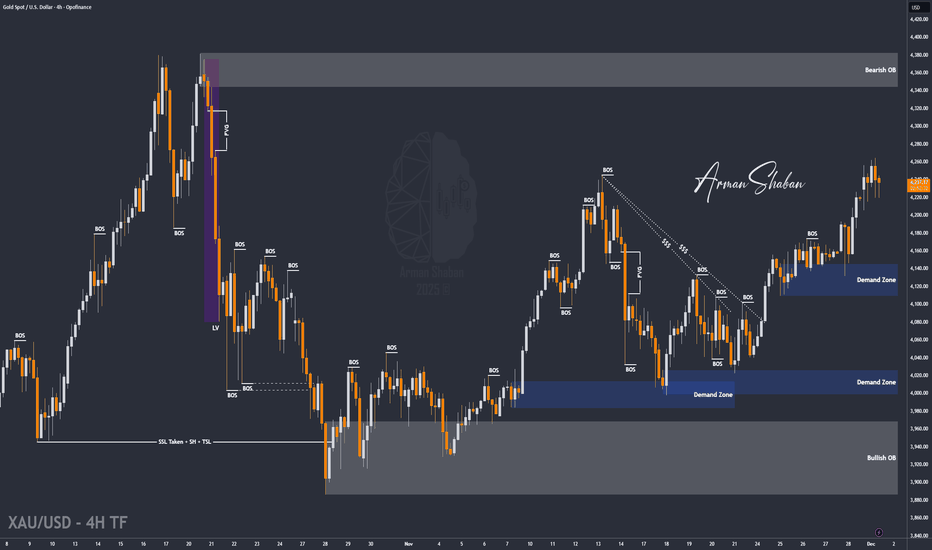

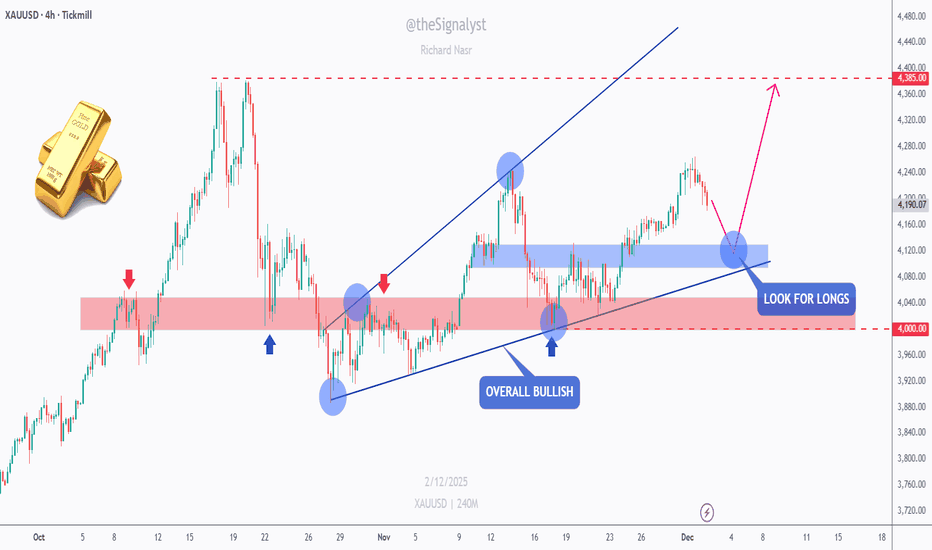

XAU/USD | Another Bullish Leg Possible! (READ THE CAPTION)By analyzing the #Gold chart on the 4 hour timeframe, we can see that price made a strong bullish jump today, pushing all the way up to $4264 before showing signs of exhaustion and pulling back. This reaction is typical after such an aggressive move, especially when price taps into short-term liquidity pockets and meets intraday supply zones.

Right now, TVC:GOLD is trading around $4228, which keeps the overall bullish structure intact. The key level to watch remains $4187, as long as price holds above this zone and doesn’t break it with a strong 4H candle close, the bullish scenario stays valid. This level is acting as both structural support and a demand area from the last impulsive move, so buyers will likely attempt to defend it.

As long as we stay above that support, we can expect the market to build another wave of bullish momentum. The next upside targets remain the same, with potential reaction zones at:

• $4240

• $4250

• $4260

• $4272

Each of these levels represents short-term liquidity pockets and minor supply areas where price may pause, react, or give another continuation setup. If bullish pressure stays strong, TVC:GOLD can attempt another push into the upper range after clearing intraday resistance levels.

Overall, the trend is still bullish as long as $4187 holds, and higher targets remain in play unless we see a deeper breakdown or a sharp shift in momentum.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Gold updateGold is holding above the rising support trendline, showing early signs of strength after tapping the 4193 support zone. If buyers sustain momentum and break above 4226, price can move toward the higher resistance at 4265, with an extended upside target near 4300. However, staying below 4226 keeps the market in a choppy consolidation phase.

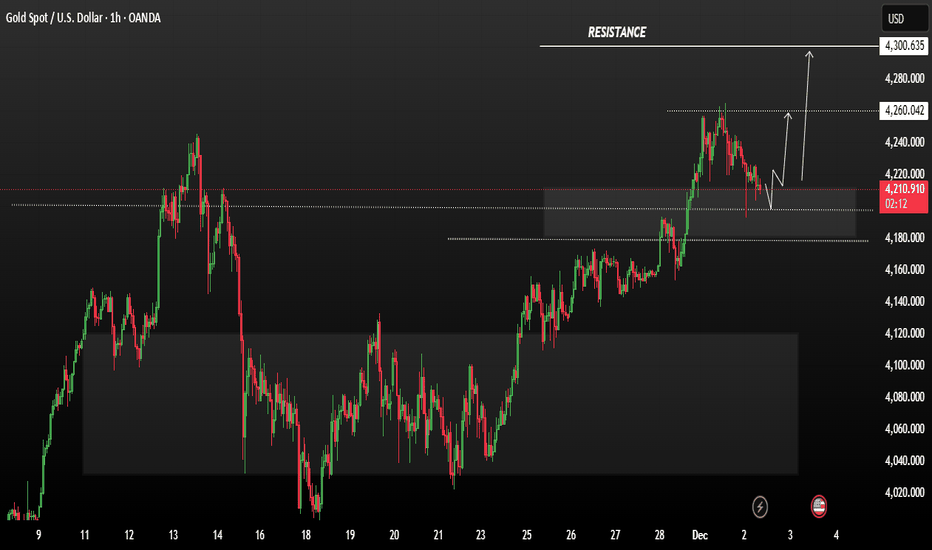

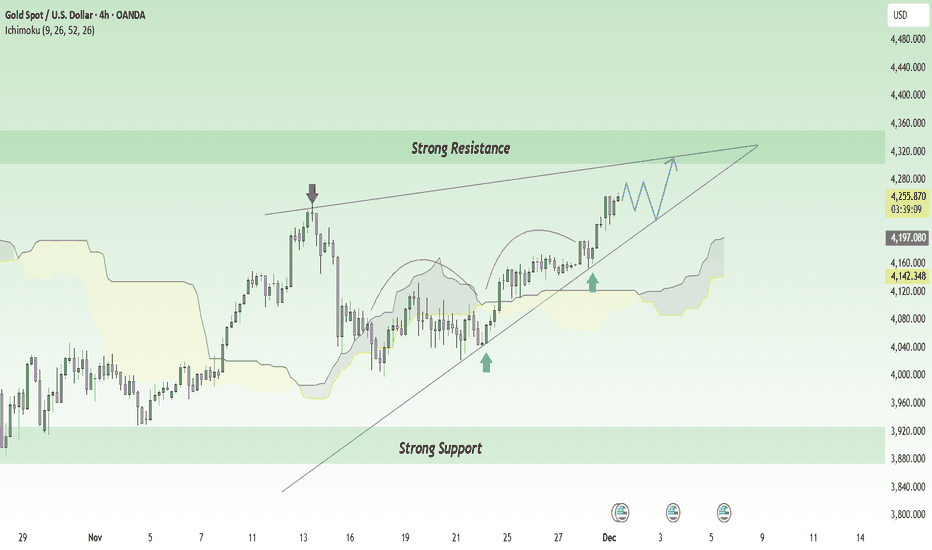

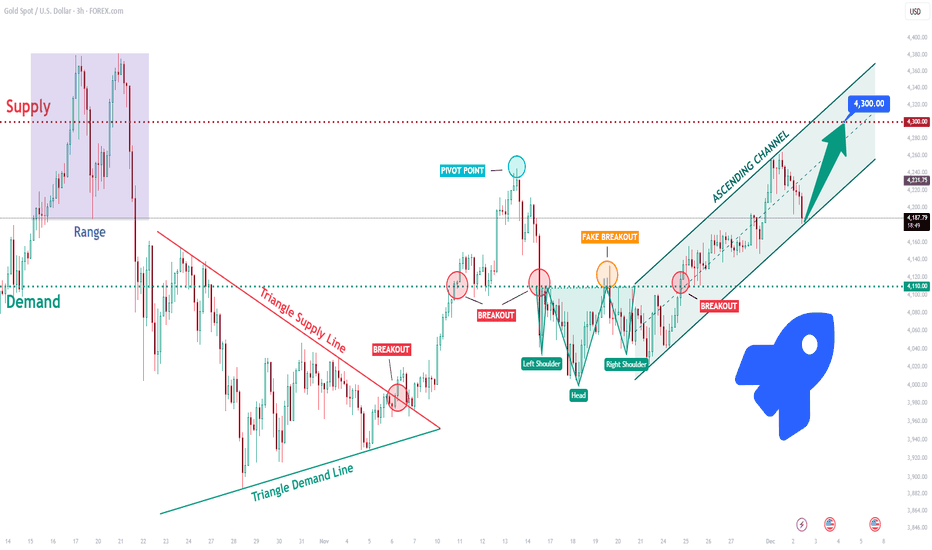

XAUUSD: Buyers Eye Retest of the $4,300 Resistance ZoneHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold continues to trade within a well-structured bullish environment following a strong recovery from the lower Triangle Support Line earlier in the month. After a prolonged corrective phase inside a symmetrical triangle, price eventually broke above the Triangle Resistance Line, shifting the market structure from consolidation into bullish continuation. This breakout created a clear trend shift, supported by a steady sequence of higher highs and higher lows. After the breakout, XAUUSD entered a temporary Range phase, suggesting accumulation from buyers before the next impulsive move. Once price broke out of that range to the upside, the market formed a clean Upward Channel, showing sustained bullish pressure. A notable fake breakout above the Resistance Zone around 4,260 occurred recently, indicating strong seller activity at the top of the zone, but buyers quickly regained control and continued to push price upward within the channel.

Currently, gold is trading near the mid-upper area of the Upward Channel, approaching the 4,300 key Resistance Zone. The broader technical picture shows clear bullish market structure, with trendline support and channel dynamics favoring further upside as long as the channel remains intact.

My Scenario & Strategy

My scenario is bullish, supported by the strong rebound within the Upward Channel and the consistent higher-low structure. As long as price remains above the 4,215–4,230 Support Zone and respects the channel’s lower boundary, buyers hold a clear advantage. My expectation is that XAUUSD may make a minor pullback toward the mid-channel zone near 4,230 to gather liquidity before continuing the upward movement.

Therefore, the primary bullish target remains the 4,300 Resistance Zone, where a retest is highly probable. A clean breakout above 4,300 would open the door for a stronger rally and signal continuation of the broader bullish cycle. However, if gold fails to break the resistance and forms a deeper correction, the Upward Channel support and the prior breakout zone at 4,215 will be key levels to watch. The bullish bias remains valid as long as these supports hold. For now, the structure favors a long scenario with attention on the move toward 4,300 and potential bullish continuation beyond that level.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

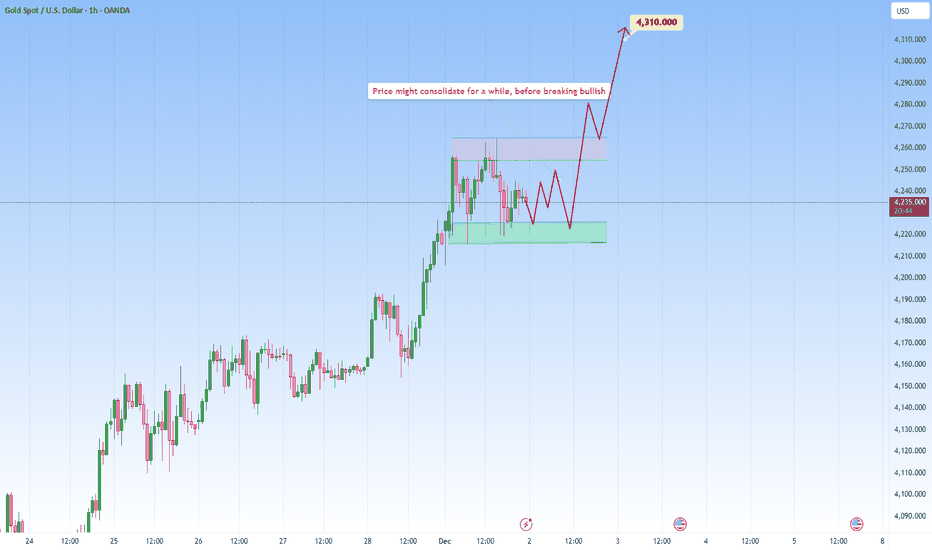

GOLD Consolidation bullish run momenmtumGold moved into consolidation after a bullish run. The metal pulled back to $4110/oz on Tuesday as investors booked profits following Monday’s six-week high. The market is now focused on U.S. interest rate expectations, with growing anticipation of a rate cut next week. Traders are also awaiting remarks from Federal Reserve Chair Jerome Powell later today for additional guidance on the Fed’s rate trajectory.

Price retested the 4205 zone and rebounded, indicating a healthy pullback within the uptrend If bulls successfully hold the 4210 support range, upward momentum could strengthen quickly On the upside, the next major resistance levels to watch are 4260 and 4300.

You may find more details in the chart.

Trade wisely best of luck buddies.

Ps; Support with like and comments for better analysis thanks for supporting.

Gold Reversal in Motion: Head & Shoulders Breakdown Hi!

Market Structure

Gold has been moving inside a clean ascending channel, with price respecting both upper and lower boundaries for several days. Earlier in the trend, we saw the first compression phase along the dashed mid-line, which later fueled the strong push toward the channel top.

Liquidity Zone – Hunt or Breakout?

At the channel’s upper boundary, price tapped a key horizontal level. The spike above it looks more like a liquidity hunt than a real breakout—buyers were trapped, and the market quickly rejected from this zone.

Reversal Pattern – Head & Shoulders

After the rejection, a clear Head and Shoulders pattern formed exactly at the top of the channel

The neckline was positioned just above the dashed trendline. Once the neckline broke, momentum shifted sharply bearish, confirming the pattern.

Target & Expected Path

The chart shows the target of the Head and Shoulders, aligned perfectly with the lower boundary of the ascending channel. This creates a strong confluence around the 4,160 area.

The projected move suggests a possible minor pullback or neckline retest before continuing downward.

Overall, the chart signals a short-term trend reversal within a long-term bullish channel, driven by liquidity sweep behavior and a confirmed Head & Shoulders breakdown.

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

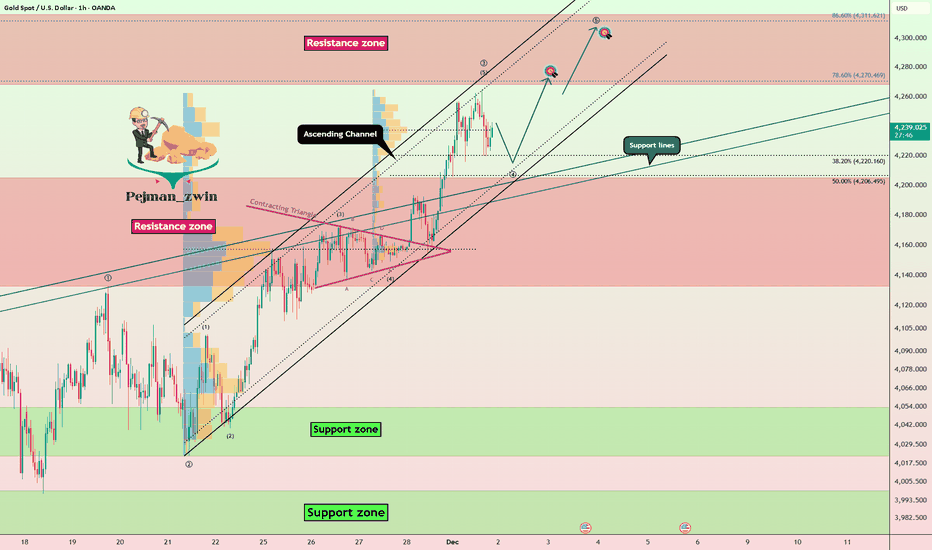

Gold Breakout + Wave Structure = New Targets LoadingGold( OANDA:XAUUSD ) has successfully broken through the Resistance zone($4,205 – $4,133) at the start of this new week, and over the past ten trading days, it seems to have formed an ascending channel.

From an Elliott Wave perspective, it looks like gold has completed wave 3 and is currently in the process of completing wave 4.

I expect that after a pullback toward the Resistance zone($4,205 – $4,133)—aligning with the lower line of the ascending channel and the support lines—gold will resume its upward movement and once again target the Resistance zone($4,316 – $4,261).

First Target: $4,266

Second Target: $4,294

Stop Loss(SL): $4,151

Note: Geopolitical tensions—especially the possibility of a direct confrontation between Venezuela and the U.S.—tend to push investors toward safe-haven assets, and gold historically reacts with strong upward momentum during such uncertainty. If this conflict escalates, increased risk aversion and volatility across global markets could support a bullish continuation in gold as capital shifts away from risk assets

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

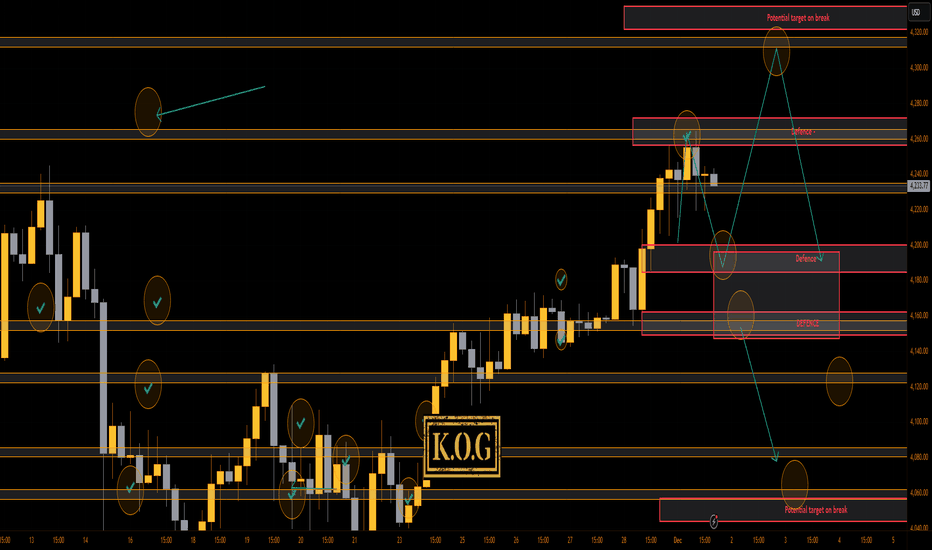

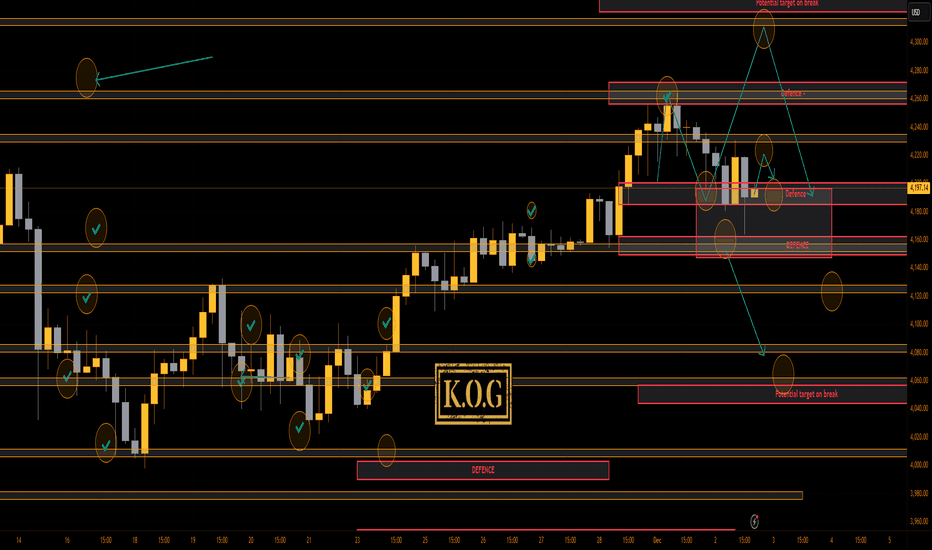

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Not a bad start to the week with price giving us a tap and bounce from that 4220 level we gave yesterday and attacking the 4260 level which we said to monitor for the rejection. The indicators gave the signal and the red box rejected, giving us a nice move downside as we wanted.

Now we have a swing low in play with the resistance level above at the 4255 level which will need to break, however, there is still defence above so we'll keep an eye on that level again over the sessions to come. Ideally, support below 4228 will be the decider!

We'll stick with the plan for now.

RED BOXES:

Break above 4230 for 4237✅, 4247✅, 4250✅ and 4260✅ in extension of the move

Break below 4210 for 4199, 4195 and 4165 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

XAUUSD: Waiting for directionPrice recently pushed to the upside, but now the market is slowing down, moving sideways.

This is classic reaction after an impulsive move. Buyers are still in control overall, but taking a breather.

A clean break above the upper range would confirm that buyers are ready to continue the trend and push for new highs.

That’s the scenario I’m watching, a bit of back-and-forth, then a breakout to the upside once the market is done consolidating.

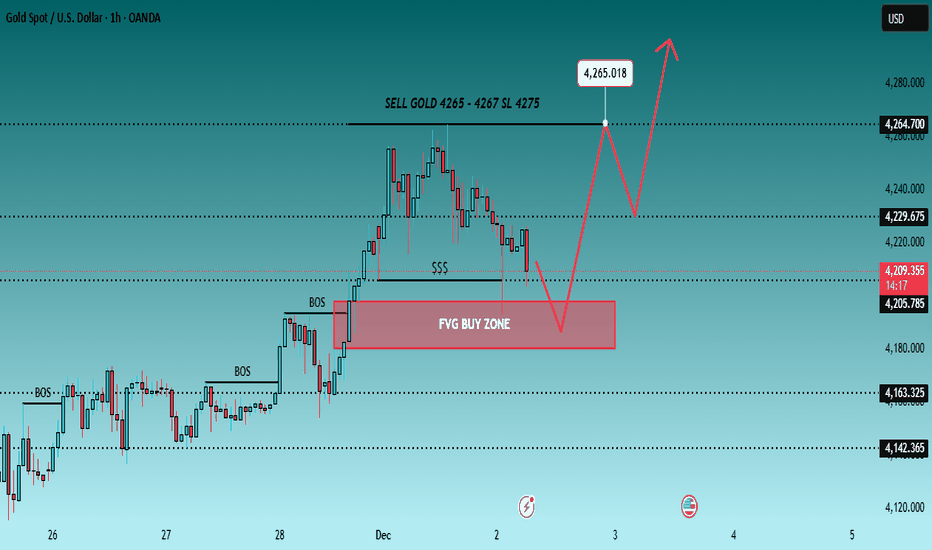

Gold 1H – Can 4265 Breakout or Trap Into 4185?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (02/12)

📈 Market Context

Gold continues its impressive rally as markets price in a potential rate cut by the Federal Reserve in December. Spot gold recently surged — reflecting multi-week highs — as the US Dollar Index (DXY) weakened. The backdrop is increasingly dovish: fading USD strength and rate-cut odds have kept gold bid.

From a technical perspective, price sits compressed at the channel top, signaling liquidity plays before the next institutional leg. Macro tone from Powell’s opening remarks on ForexFactory adds volatility fuel.

🔎 Technical Framework – Smart Money Structure (H1)

Current state = Accumulation / Distribution within rising channel

Liquidity zones & key triggers

• Premium liquidity zone (sell-opportunity): ~4265–4267 (upper-edge pool of liquidity)

• Discount liquidity zone (buy-origin / re-entry zone): ~4186–4184 (demand liquidity near prior displacement base)

• Equilibrium / chop zone: mid-channel compression → no blind trading unless structure validates direction

Expected Smart Money sequence

Sweep → CHoCH/MSS → BOS → Displacement → FVG/OB Retest → Expansion

Gold remains primed for a directional move only after structure confirms intent.

🎯 Trade Plans for Today

🔴 SELL GOLD 4265 – 4267 | SL 4275

• Thesis: Liquidity sweep above equal highs at premium edge, followed by engineered bearish BOS confirming institutional selling intent.

• Entry rules (must wait for confirmation):

✔ Price pokes 4266 zone → bearish CHoCH/MSS + BOS down (M5–M15)

✔ Entry on FVG fill or OB retest after BOS validation

• Targets:

1. 4245 – 4240 (first reaction)

2. 4225 – 4215 (channel EQ retest)

3. 4186 – 4184 (full delivery into discount)

🟢 BUY GOLD 4186 – 4184 | SL 4176

• Thesis: Discount liquidity tap at institutional base, buy absorption after sweep + bullish BOS signaling new intraday demand.

• Entry rules (must wait for confirmation):

✔ Price sweeps 4185 → bullish CHoCH/MSS + BOS up (M5–M15)

✔ Entry on rejection wick + FVG fill or OB retest confirmation

• Targets:

4. 4215

5. 4240

6. 4265+

⚠️ Risk Management & Notes

• Avoid trading inside mid-range without CHoCH/BOS validation — sweeps are traps until proven by MSS + BOS.

• Use SL for structure invalidation only — no averaging in compression.

• Reduce lot size during Powell’s delivery window; macro impulses can run both sides of liquidity fast.

📍 Summary

Gold is coiling at highs for liquidity. Either Powell triggers a 4266 sweep → bearish BOS → delivery, or price hunts 4185 discount → bullish BOS → continuation.

Trade the structure, not the narrative — wait for CHoCH & BOS + retest to unlock expansion.

📌 Follow @Ryan_TitanTrader for daily Smart Money updates.

Is Gold Just Resting — or Ready to Rise Again?Hello traders, let’s take a look at XAUUSD together today!

At the moment, XAUUSD looks like a wave pulling back only to gather momentum — not weakening, but preparing for the next upward move . After hitting a six-week high, gold is seeing some light profit-taking, but the macro backdrop still leans strongly toward the bulls: the Fed is sending dovish signals , the USD is weakening, and soft U.S. data continues to support this mild bullish trend .

Looking at the chart, price was previously rejected at the upper resistance zone and has now pulled away from the descending resistance line. Even so, the overall bullish structure remains intact . Gold is heading toward the 4,170 support zone, which aligns with a strong previous reaction area — and may dip slightly deeper into 4,120, a confluence of old lows and a strong rejection zone. These are the two areas where buyers are most likely to return .

The high-probability scenario: XAUUSD taps 4,170, forms a consolidation base, and then rebounds toward 4,250. If sellers push price further to 4,120, this will become the last critical support before gold triggers its next upward wave. Only a clear break below 4,120 would significantly threaten the mild bullish outlook.

For now, the main story remains unchanged: gold is correcting, not reversing . And every pullback toward support continues to be an opportunity to watch for the buyers’ return — to fuel the next bullish leg in the days ahead.

XAUUSD Market Outlook — Targets AheadThe XAUUSD chart shows price reacting strongly from a major resistance zone highlighted by the blue area, where price has previously reversed. After retesting this resistance again, price formed a rejection candle, signaling a potential short-term pullback. The market is still respecting the ascending trendline, but a break below it would confirm downside momentum. If price fails to break above the resistance zone, the bearish correction may continue toward the marked support levels. Target 1 is 4,192, where initial support and minor structure align. A deeper move could extend toward Target 2 at 4,153, which matches previous demand and cloud support. A break below these levels may open the way toward lower zones.

If you found this XAUUSD analysis helpful, don’t forget to LIKE 👍 and COMMENT 💬!

XAUUSD - The Golden Retest Zone!📈Gold remains overall bullish , respecting its rising structure and printing higher lows along the way. Each corrective dip has been met with strong buying pressure, keeping the broader trend intact.

📉As price pulls back, it is now approaching a key blue structure zone that aligns perfectly with the lower blue trendline. This intersection forms a high-confluence area where we will be looking for trend-following longs.

⚔️As long as Gold holds this zone, the bullish scenario remains dominant, with the next potential push targeting the previous ATH highlighted on the chart.

🏹A clean reaction here could be the catalyst for the next leg of the uptrend.

Will the bulls defend the golden zone again? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Gold Moves Sideways Ahead of the FED DecisionGold continues to trade within an extremely tight range, even as the USD Index (DXY) stabilises around 99–100. This signals that pressure from the dollar is no longer as dominant as before, while safe-haven flows quietly circulate beneath the surface—especially as global equities soften and sentiment grows cautious ahead of the FED’s rate announcement this month. Everything now hinges on a single question: will the FED deliver its third rate cut of the year? If so, the USD is likely to weaken, and gold could benefit directly and even aggressively from the shift.

On the 1H timeframe, gold remains sideways between 4,210–4,220 after retracing from 4,245–4,260. Notably, recent selling appears to come primarily from short-term profit-taking rather than genuine reversal pressure. The lower FVG zones at 4,185–4,195 and 4,160–4,170 continue to act as liquidity pockets where price may dip to gather momentum before following the prevailing trend. These areas have provided precise reactions in previous sessions and could again serve as springboards should gold pull back deeper.

If gold holds 4,210 and shows a strong bullish response, a retest of 4,245 becomes highly likely, with a potential breakout above 4,260 toward the broader target near 4,285—the key high from November. Conversely, a clean break below 4,210 opens the path for price to drift naturally into the 4,185–4,195 FVG before buyers step in. In the broader structure, the short-term uptrend remains intact; current pullbacks are functioning as liquidity sweeps rather than structural breaks.

With all of this in mind, my bias stays bullish. The 4,185–4,195 region is where I prefer looking for trend-aligned entries instead of chasing price near the 4,245–4,260 resistance, where sellers repeatedly wait. Should the FED deliver the dovish signal the market expects, gold could easily extend its upward trajectory in the sessions ahead.

Gold Holds Its Breath Ahead of PMI: Breakout or Breakdown?If I had to describe gold right now, I’d call XAUUSD a “predator hiding in the bushes” — no longer in a wild breakout phase, but quietly waiting, watching, and preparing for the next news-driven move.

In terms of fundamentals, the market is awaiting the U.S. ISM Manufacturing PMI, forecast at 49.0, slightly higher than the previous 48.7, but still below the 50 threshold . In other words, the U.S. manufacturing sector is expected to look “less bad,” but not strong enough to change the bigger picture. With that backdrop, neither the USD nor gold has a solid reason to break out before the data — sentiment is simply: wait for the actual numbers, then move.

On the H4 chart, gold is pressing against the upper trendline, right at the 4,300–4,310 resistance zone , while support sits below at the 4,220 level overlapping the rising trendline and the Ichimoku cloud . These two areas form a natural “price box”: the top attracts profit-taking from buyers, the bottom attracts fresh dip-buyers — a classic setup for a healthy sideway accumulation phase.

My preferred scenario: XAUUSD may continue oscillating between 4,220–4,310, where spikes toward 4,30 tend to trigger selling, while dips to around 4,22 draw in buyers. As long as price does not clearly break out of either boundary, I consider this a sideway market within a larger bullish structure , ideal for trading the range rather than trying to predict the next breakout.

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

As we said yesterday we would stick with the plan from Sundays report which has worked well so far. We managed to get the move up and down, then another red box trade for a long and some traders even went in for the short from our given level of 4328,

Now, we may experience some ranging with the key level at the hot spot 4220and support at the hot spot 4187. We would like to see this go a little higher but that resistance is important for the break!

As always, trade safe.

KOG

XAUUSD Long: Channel Support Holding — Buyers Target 4,300 ZoneHello, traders! The price auction for XAUUSD has been unfolding within a clearly structured bullish progression after a period of heavy distribution inside the Supply Zone. Earlier, gold established a wide Range between the Supply and Demand areas, with multiple sharp rejections forming the top of the structure. Eventually, sellers pushed the price lower, initiating a corrective decline that developed into a well-defined Triangle Pattern, marked by a descending Triangle Supply Line and a rising Triangle Demand Line. This compression ended with a clean breakout to the upside, signaling the beginning of a new bullish phase. Following the breakout, XAUUSD formed a Pivot Point near the mid-range level, where price briefly rejected before continuing its upward trajectory. Another notable phase was the formation of an inverse Head-and-Shoulders structure, confirming buyer strength after a fake breakout below the neckline. This reversal pattern provided the foundation for the current bullish continuation.

Currently, gold is trading inside a strong Ascending Channel, respecting both channel boundaries with consistent higher highs and higher lows. The latest breakout from the mid-channel zone has kept the bullish structure intact, and after a corrective pullback to the lower channel boundary, price is attempting to resume upward movement. As long as price holds within this channel, the market dynamics favor a continuation toward the 4,300 resistance target, which aligns with the upper boundary of the channel and the previously broken structure.

My scenario for the development of events is bullish, with expectations of a rebound from the lower channel boundary followed by a continuation toward the 4,300 resistance level. In my opinion, maintaining structure within the ascending channel supports further upside as long as buyers defend the 4,110 support region below. Manage your risk!

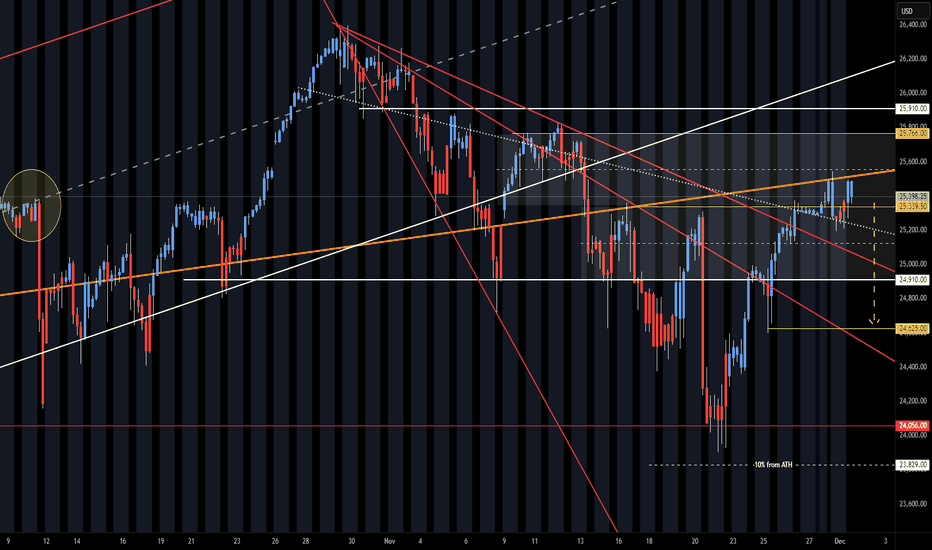

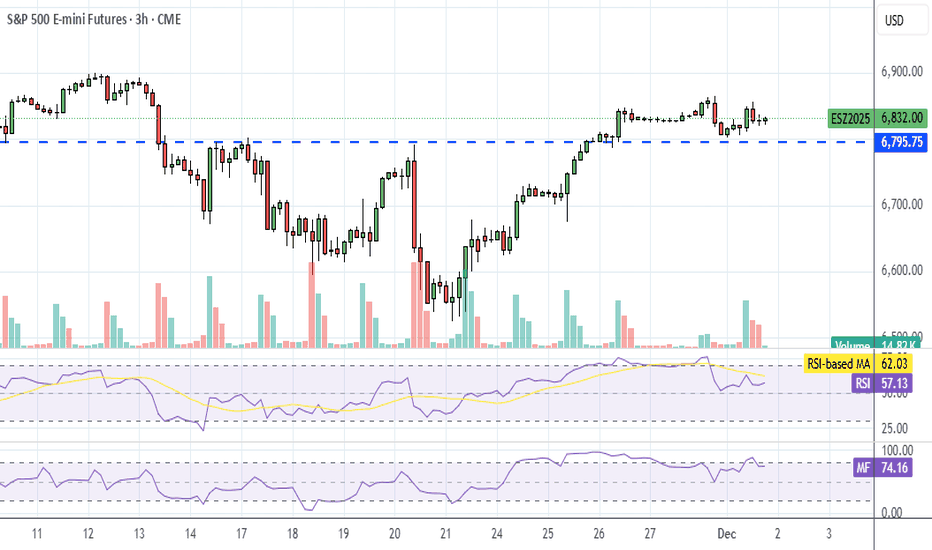

ES UpdateIs the melt up over? I dunno, probably staying out at least another day. Trying to avoid the whipsaw.

The problem with a melt up is that indicators won't tell you when it's gonna be over. What I can tell you is that the gap from last week filled, as expected.

I don;t think I want to go long until FDAX goes oversold anyways.