XAUUSD: Bearish Order Flow Confirmed? Shorting the Supply Zone.

After updating the All-Time High (ATH), Gold performed a micro-sweep of liquidity from the previous ATH. This move was engineered via a Supply Zone. Following the sweep, this zone was mitigated, initiating a bearish order flow that broke the 4H structure to the downside (BOS 4H).

After the structural break, the price began approaching a second Supply Zone. A reversal is possible from this area to continue the bearish order flow, targeting an update of the structural low at $4000. A full break of this low would indicate a high probability of a deeper correction on the higher timeframe.

✅ Short Setup Conditions:

Aside from the mitigation of the Supply Zone, I am looking for a reversal reaction from the 61.8% Fibonacci retracement level. The price must find acceptance below this level upon reaching it.

❌ Invalidation:

The short scenario is invalidated if the 61.8% level is broken. In that case, Gold will face further resistance at the 78.6% Fib level, but forming a short setup there is less probable than from the 61.8%.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

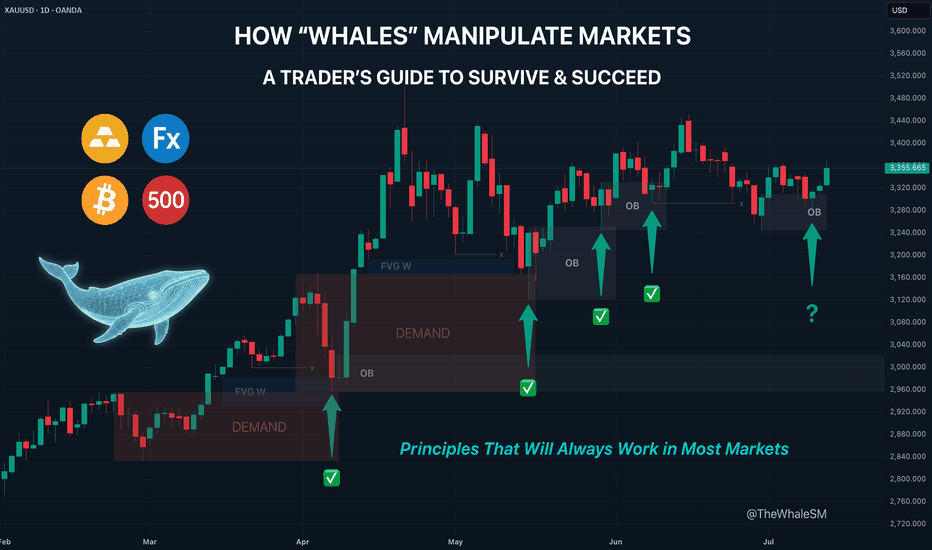

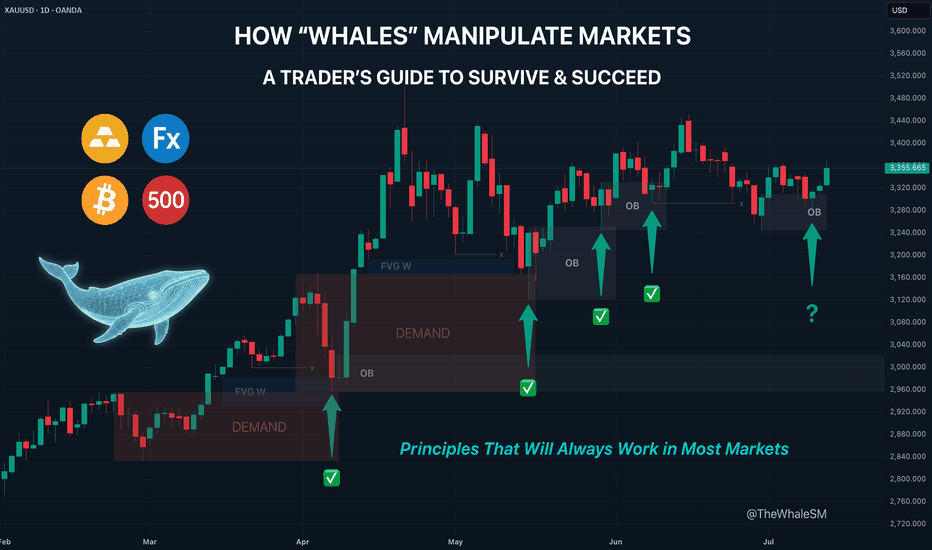

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView for timely updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

After the structural break, the price began approaching a second Supply Zone. A reversal is possible from this area to continue the bearish order flow, targeting an update of the structural low at $4000. A full break of this low would indicate a high probability of a deeper correction on the higher timeframe.

✅ Short Setup Conditions:

Aside from the mitigation of the Supply Zone, I am looking for a reversal reaction from the 61.8% Fibonacci retracement level. The price must find acceptance below this level upon reaching it.

❌ Invalidation:

The short scenario is invalidated if the 61.8% level is broken. In that case, Gold will face further resistance at the 78.6% Fib level, but forming a short setup there is less probable than from the 61.8%.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView for timely updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note

XAUUSD | UPDATEThe Daily timeframe shows the potential birth of a bearish order flow on the higher structure as well. This manifested as a reversal reaction to the first Daily Order Block (OB1).

Now, if we see a reversal reaction from the second Daily Order Block (OB2), the bearish order flow will be confirmed, and Gold could enter a deep corrective decline.

The first daily candle that reached the 61.8% Fib level closed with its body below it. Whether a reversal happens from this level depends on how the second daily candle closes.

— If it also closes with its body below the level, it confirms acceptance, and we can look for a short entry on the 1H-4H structure.

— However, if today's daily candle closes with its body above the 61.8% level or continues to rise directly to the 78.6% level, we can expect a reversal reaction there as well (price must find acceptance below it upon reaching it).

Context (

An important factor for Gold's near-term performance is the Dollar Index. Its correction was paused by the 50% Fib level, but the index stopped just short of the Bullish Order Block. If DXY continues its corrective decline to the 61.8% or 78.6% Fib levels within that OB, Gold may still push up to its own 78.6% level.

Conclusion:

I am waiting to see how price behaves on Gold and DXY; tomorrow should bring more clarity.

I will keep you updated on every step. Follow me so you don't miss this potential high-probability move on the higher structure.

Note

XAUUSD | UPDATEYesterday's daily candle closed with its body above the 61.8% Fib level, so it can be considered practically broken. The only thing that could prevent this (if the price does not immediately continue to rise to the 78.6% level today) is a full engulfing of yesterday's green candle by today's red one. However, it looks more likely that the 78.6% level will be reached, and the 61.8% level is definitively broken.

The Dollar Index (

There is no confirmation for a short yet, so I continue to monitor how both instruments behave interacting with their levels.

Note

XAUUSD | UPDATESo, the 61.8% level was broken, and price reached the final resistance — the 78.6% level.

Given that the last trading day before the weekend is ending soon, and markets are closing early for Thanksgiving, one must be especially careful with opening trades due to low liquidity and potential squeezes.

The fate of the 78.6% level will likely be decided next week. If it is broken, there is a high probability that nothing will stop Gold from forming a full-fledged new ATH, barring unforeseen macroeconomic or political events.

Note

XAUUSD | UPDATEThe 78.6% Fib level was broken almost immediately, but I did not expect serious resistance from it initially if the 61.8% level was breached, as noted in the invalidation condition of the short scenario from the local SUPPLY zone:

The short scenario is invalidated if the 61.8% level is broken. In that case, Gold will face further resistance at the 78.6% Fib level, but forming a short setup there is less probable than from the 61.8%.

Although the original short idea was invalidated back on Nov 28, I have continued to monitor the short thesis more broadly since this idea was selected as an Editor's Pick.

Continuing the search for short opportunities (as longs are unacceptable to me at current prices without a pullback to a discount zone), I want to draw attention to the fact that today, the first trading day of the month, defined the Previous Month High (PMH), and liquidity from this high was immediately swept.

Effectively, this high has turned into the final resistance before the formation of a full-fledged new ATH. It is crucial to see how price interacts with this level now.

- If the next few Daily candles close with their bodies below this level (leaving only wicks above), or if today's bullish candle is fully engulfed by tomorrow's bearish one, the asset will be ready for a significant corrective drop.

- If price continues to rise today/tomorrow, the short scenario is fully canceled, and a new ATH is inevitable.

Context (

An additional clue will be the Dollar Index, which is also near a key level: a Daily Break of Structure (BOS D), which is also the Previous Month Low (PML). A liquidity sweep (wick) of this level followed by acceptance above it would imply DXY growth toward at least the Bearish Order Block above. Due to inverse correlation, this would signal the start of a corrective decline for Gold.

I continue to monitor the situation; the next couple of days should clarify the asset's intention.

Note

XAUUSD | UPDATEThe first Daily candle closed with its body below the level of the liquidity sweep from the Previous Month High (PMH), taking liquidity only with its wick. This has increased the probability of a reversal from this level.

However, confirmation is still needed in the form of a second candle closing with its body below the sweep level and engulfing yesterday's bullish candle.

The Dollar Index (

This scenario of DXY sweeping the remaining lower liquidity can be analyzed in more detail on the 1H timeframe of Gold. It shows that the local downward move was engineered via manipulation in the form of a 1H Order Block.

A mitigation of this Order Block and a reversal reaction from it (combined with the aforementioned factors on the HTF of DXY and Gold) will reveal a specific entry point for a short.

🚀 Get my Institutional Trade Setups & Watchlist.

Stop guessing. Get the exact Levels, POIs & Trade Plans I am watching daily.

Exclusive for my community.

► Get Free Access:

thewhalesm.com

Stop guessing. Get the exact Levels, POIs & Trade Plans I am watching daily.

Exclusive for my community.

► Get Free Access:

thewhalesm.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🚀 Get my Institutional Trade Setups & Watchlist.

Stop guessing. Get the exact Levels, POIs & Trade Plans I am watching daily.

Exclusive for my community.

► Get Free Access:

thewhalesm.com

Stop guessing. Get the exact Levels, POIs & Trade Plans I am watching daily.

Exclusive for my community.

► Get Free Access:

thewhalesm.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.