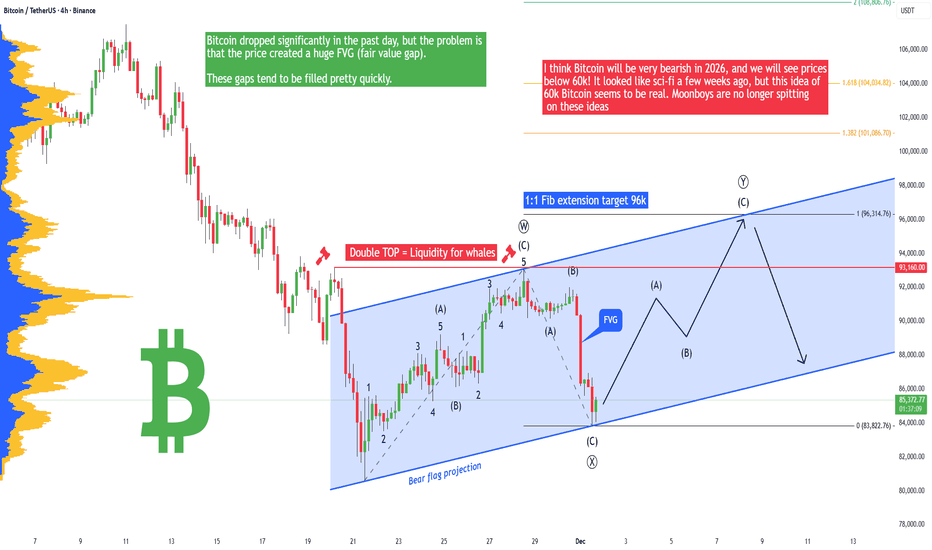

Bitcoin - Fake drop! Soon return to 96k (December PUMP!)Bitcoin has dropped like crazy in the past day because we are in a strong bear market, but I think we should see a December rally! I have been warning you against these big crashes pretty much since Summer 2025. I knew it was going to happen - the question was not if but when.

The price created a huge FVG, and this gap is very unfilled. Pretty much it looks like a huge manipulation from big players (they sent the price down significantly to liquidate high-leverage traders on futures). You know that the Bitcoin market is completely manipulated by the Fed, banks, and huge institutions. They even have a roadmap, and they know what the price of Bitcoin will be in 2030 and 2040. I know everyone hates the Fed and banks, but this is how it is. We trade it, so you have to be able to predict their movements and trade with their plan.

I think Bitcoin will be very bearish in 2026, and we will see prices below 60k! It looked like sci-fi a few weeks ago, but this idea of 60k Bitcoin seems to be real. Moonboys are no longer spitting on these ideas, and some people are calling for 30k or 40k Bitcoin. Let me know in the comment section your prediction. I am curious! You have to understand that there is a lot of manipulation going on in this world. We live in a physical world that has been created recently. The original astral world is where the magic happens. And yes, the physical world is a scam and fraud. The sooner you understand that after you're dead, you wake up in the original astral world, the better for you.

Currently, I am pretty bullish, I think we will see a bullish rally sooner rather than later!

Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

Crypto market

Crypto Winter 2026: BTC 75% Correction PT 30 000 USDInvestment Memo: Anticipating a 2026 Bitcoin Crypto Winter

By ProjectSyndicate

________________________________________

1. Executive Summary

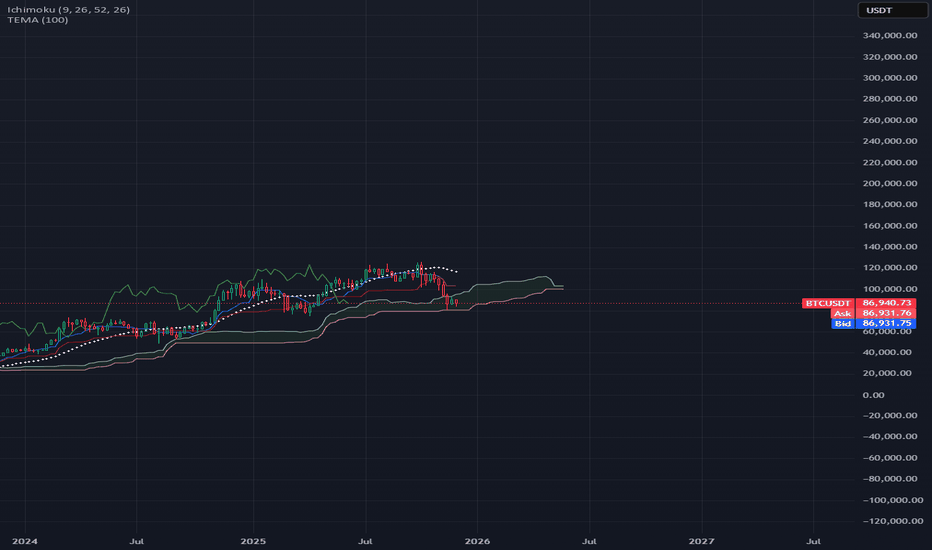

❄️ Summary view: This memo treats 2026 as the high-probability crypto winter year for Bitcoin following the 2024 halving, with a working top around 123,000 USD and an expected cycle low near 30,000 USD, implying roughly a 75–76% drawdown from the peak. This is fully consistent with historical Bitcoin bear markets, which have typically seen 75–85% corrections from all-time highs.

❄️ Contrarian hook: While mainstream narratives still focus on ETFs, institutional adoption, and “crypto as macro asset,” the explosion of leverage (Aster DEX up to 1001x), CZ-backed perps, and BNB-chain meme-coin mania are treated here as late-cycle excess—classic topping signals rather than sustainable foundations.

________________________________________

2. Thesis & Target Range

📊 Cycle top assumption: cycle high of ~123,000 USD per BTC. That is well within the band implied by recent ATH prints ~125–126k in mid-2025 and aligns with a typical “blow-off” overshoot above the prior psychological milestone at 100k.

📊 Cycle low assumption: 30,000 USD downside target represents a drawdown of ~75.6% from 123,000 USD—slightly shallower than the 2018 crash (~84%) and broadly in line with the 2021–22 bear (~77% from 69k to ~15–16k). That keeps this winter brutal but not apocalyptic, consistent with a maturing asset still capable of deep mean reversion.

🧮 Math check on prior winters

• 2017–18: 19k → 3k ≈ 84% drawdown

• 2021–22: 69k → 16k ≈ 77% drawdown

• 2025–26 (your base case): 123k → 30k ≈ 76% drawdown

This places scenario squarely inside the historical corridor of 75–85% post-peak corrections.

________________________________________

3. Historical Pattern: Why Large Drawdowns Are the Base Case

📉 Structural volatility: Bitcoin’s entire price history is punctuated by massive post-parabolic drawdowns—early cycles saw 86–93% collapses, later ones 75–80%. Each halving-to-peak run has ended in a violent crash once marginal buyers are exhausted and leverage saturates.

📉 Time dimension: Historically, the “winter” phase has lasted 9–18 months from peak to capitulation and then a long grinding accumulation. The 2017 peak to 2018–19 bottom spanned roughly a year; the 2021 peak to 2022–23 nadir similarly took about a year, with a further period of sideways chop.

📉 Drawdown normalization: Traditional asset allocators increasingly frame Bitcoin as an alternative macro asset, but the statistical reality is unchanged: drawdowns of 70%+ are not outliers—they are typical. An assumption of only shallow corrections is the non-consensus view; a 75% winter is actually the boringly normal scenario from a historical distribution standpoint.

________________________________________

4. Where We Are in the Current Cycle

⏳ Post-halving positioning: The fourth Bitcoin halving occurred in April 2024, cutting block rewards to 3.125 BTC and effectively tightening supply. Historically, the major blow-off tops occur 12–18 months after halving, as reduced supply + narrative momentum pulls in late-stage retail and leverage.

⏳ Evidence of late-cycle behavior: By mid-2025, Bitcoin had already pushed to new ATHs above 100k and then into the ~120–126k region, with growing signs of ETF saturation, institutional FOMO, and leverage-driven upside. From a purely cyclical lens, we are more likely in the “euphoria / distribution” band than in early bull territory.

________________________________________

5. Aster DEX & Meme-Coin Mania as Contrarian Top Signals

🚨 Aster DEX as the “Hyperliquid of BNB Chain”: Aster DEX, emerging from APX Finance and Astherus and explicitly leveraging Binance’s network, is marketed as a high-performance perp DEX with MEV-resistant trading and leverage up to 1001x, backed by CZ/affiliate ventures. From a contrarian perspective, this is textbook late-cycle: maximum leverage offered to the broadest possible audience at or near cycle highs.

🚨 BNB meme-coin carnival: Simultaneously, BNB-chain meme coins and speculative listings (Maxi Doge, PEPENODE, various new BNB meme projects) are being pushed as high-beta “next 100x” plays. Historically, similar episodes—2017 ICOs, 2021 dog-coin and NFT mania—have coincided with or slightly lagged Bitcoin’s macro top rather than signal early-cycle value.

🎭 Narrative pattern recognition: In prior cycles, the market’s center of gravity shifted from Bitcoin to highly speculative edges (ICOs, NFTs, obscure DeFi, meme coins) at the very end of the bull. Late-cycle liquidity rotates into lottery tickets while BTC quietly transitions from “must own” to “source of funds.” The current Aster + BNB meme complex rhymes strongly with that historical script.

________________________________________

6. Why a 75% Drawdown to 30,000 USD is Plausible

🧊 From 123k to 30k mechanically: A move from 123k to 30k doesn’t require structural failure; it merely requires a reversion to historical drawdown. That kind of move can be achieved by:

• ETF inflows slowing or turning to mild outflows

• Derivatives funding turning negative as carry trades unwind

• A moderate macro risk-off (equities correction, higher real yields)

🧊 Maturing, not invincible: As adoption broadens—spot ETFs, institutional mandates, integration into macro portfolios—Bitcoin’s upside may gradually compress, but liquidity cycles and leverage cycles haven’t vanished. Even if each cycle’s drawdown edges slightly lower from ~85% to ~77%, there’s no reason to assume sub-50% drawdowns are the new regime. A respectable winter at 30k is almost conservative relative to earlier -80%+ events.

________________________________________

7. Why the Floor Might Hold Above Prior Lows

🛡️ On-chain + macro floor logic: Without pinning to proprietary on-chain models, two simple supports for a 30k floor are:

• Institutional cost basis: A growing chunk of supply is held via ETFs and treasuries accumulated in the 40–70k band. Many of these players may defend positions with hedging or incremental buying in the high-20k / low-30k region rather than panic-sell at -70–80%.

• Realized price ratcheting higher: Across cycles, Bitcoin’s long-term realized price average on-chain cost basis tends to step up structurally. Past winters have bottomed not far below that long-term average; as the realized base rises, so does the likely bear-market floor.

🛡️ Regime shift vs. previous cycles: In 2018 and 2022, Bitcoin was still climbing the wall of institutional skepticism. By the mid-2020s, you have:

• Spot ETFs

• Corporate treasuries

• Sovereign/FI experimentation

These players typically do not capitulate to zero; they reduce risk, but they also accumulate in stress. That supports the idea of a shallower floor (30k) instead of a full 85–90% purge.

________________________________________

8. Timing the 2026 Winter

🧭 Halving + 18-month lag template: Using the standard halving cycle template, major tops often occur 12–18 months post-halving, and winters then dominate the following year. With the fourth halving in April 2024, a 2025 ATH and a 2026 winter are exactly what the simple cycle model would project.

🧭 Scenario sketch

• 2025: Distribution at elevated levels (80–120k+), persistent Bitcoin as digital gold narrative, alt & meme blow-off, over-issuance of high-leverage products (Aster, other perps).

• 2026: Liquidity withdrawal + ETF fatigue + regulatory flare-ups → a stair-step decline through 80k, 60k, 45k, culminating in capitulation wicks into the 30–35k zone before a multi-month bottoming process.

________________________________________

9. Market Structure Stress Points in a Winter Scenario

🧱 Leverage cascade risk: Perp DEXs offering hundreds to 1000x leverage attract the most price-insensitive flow at the worst time. When BTC breaks key levels (e.g., 80k → 60k → 50k), auto-deleveraging and forced liquidations can accelerate downside far beyond spot selling. Aster-style platforms, while innovative, mechanically create risk of cascading liquidations in a volatility spike.

🧱 Alt & meme vaporization: BNB meme coins and other speculative assets that rode the late-cycle pump will likely see 90–99% drawdowns, as in previous winters where smaller alts dramatically underperformed BTC. In your framework, BTC at 30k is actually the “high-quality survivor” outcome; the majority of late-cycle tokens may never reclaim their peaks.

🧱 Mining and infrastructure: With halved rewards and a much lower BTC price, marginal miners will be forced offline, just as in prior winters. That tends to deepen the short-term pain but ultimately improves the cost curve (strong miners consolidate, inefficient ones exit), laying groundwork for the next cycle.

________________________________________

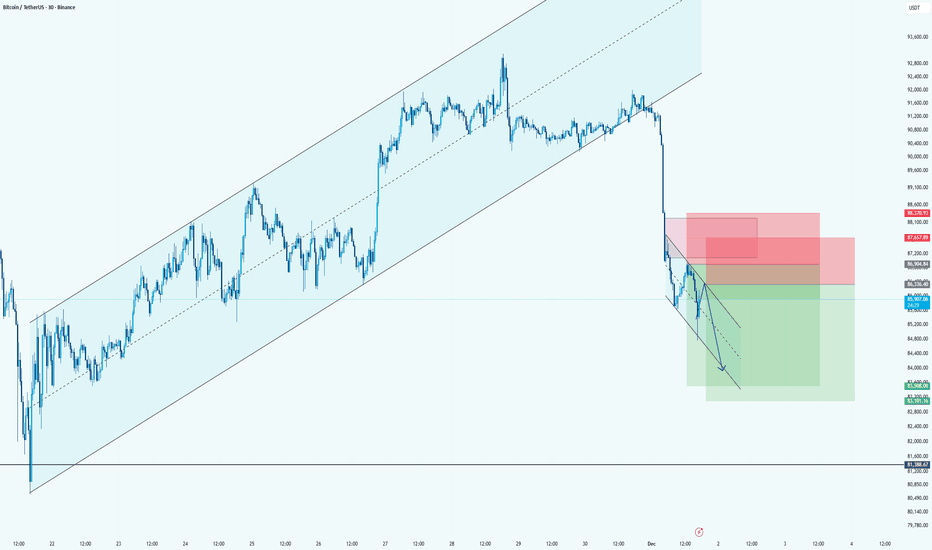

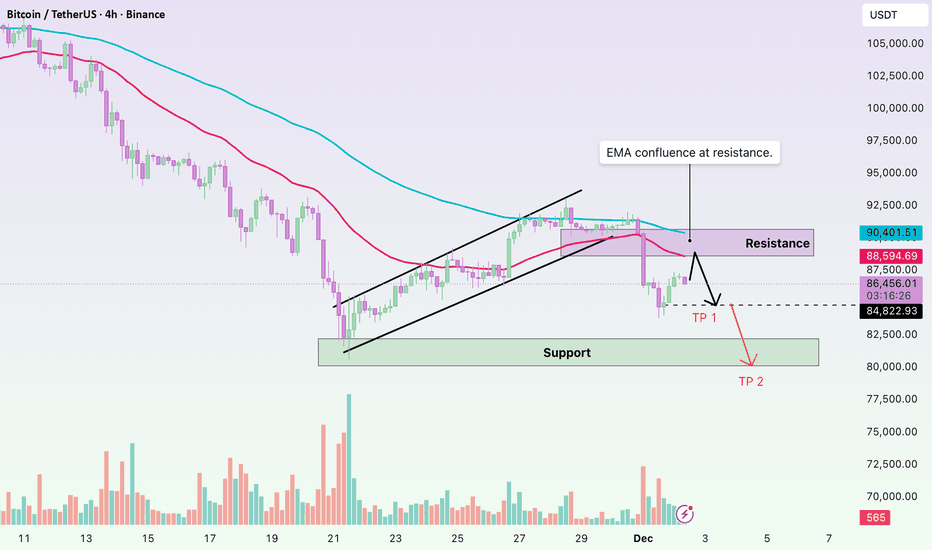

BTC: Bearish Continuation Setup After Major Channel BreakdownHi!

Price broke hard below the long-term ascending channel, confirming a clear shift from bullish to bearish momentum.

After the breakdown, BTC is moving in a small descending correction channel, creating a classic lower-high retracement toward supply.

Direction: Short

Entry Area: 87,200 – 88,300 (two stacked red zones)

Stop-Loss: Above 88,700–89,000 (top of supply)

Target: 83,000 – 84,800 (large green demand area)

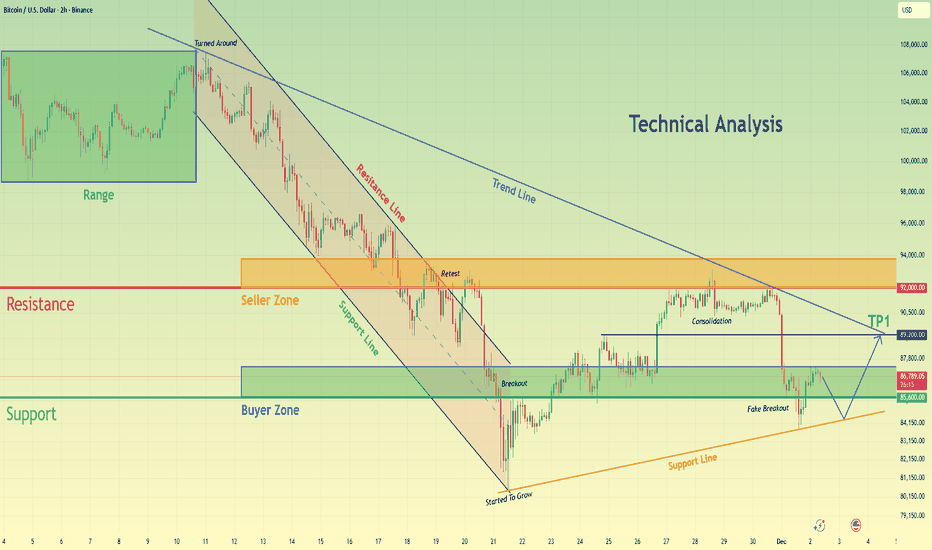

BTCUSD Long: Volatility Rising — Retest of 90,000 ExpectedHello, traders! The price auction for BTCUSD has been in a corrective phase, forming a broad descending structure guided by the major Trend Line. This bearish pattern has been defined by a sequence of lower highs and lower lows, with price repeatedly getting rejected from the Supply Zone and consolidating inside the highlighted range. The market has respected both the descending supply line and the rising Demand Line, creating a well-defined compression of price action.

Currently, the auction is at a critical inflection point, with BTC retesting the Demand Line near the 85,600 demand level. After a series of volatile moves inside the range, the price is attempting to stabilize at this structural support while gradually approaching the descending trendline once again. This tightening of volatility between supply and demand suggests that a significant directional move is likely to occur soon.

My scenario for the development of events is a bullish rebound from the Demand Line, followed by a test of the descending supply line. I expect the price to attempt an impulsive breakout toward the major Supply Zone. In my opinion, a successful breakout above this zone may carry BTC toward the 92,300 resistance target marked on the chart. Manage your risk!

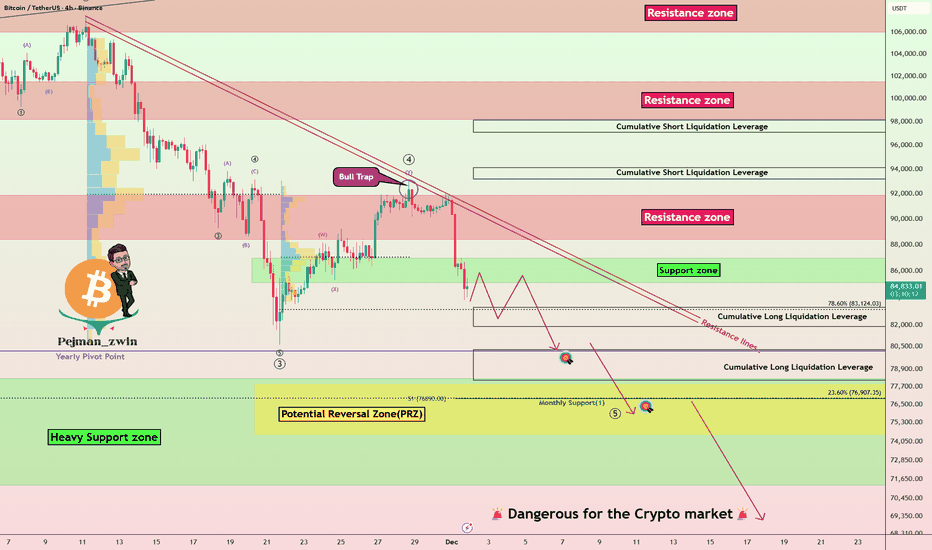

Bitcoin’s Worst November Ever — More Dump?In the past 24 hours, Bitcoin( BINANCE:BTCUSDT ) has dropped by more than -8%, marking its worst November performance ever, with a decline of about -17.67% this month alone.

Now, the question is whether Bitcoin will continue its downward trend or start to rebound. So, stay tuned!

At the moment, it seems that Bitcoin has successfully broken through the support zone($87,000-$85,130) and is moving toward the Cumulative Long Liquidation Leverage($83,273-$81,900).

From an Elliott Wave perspective, it appears that Bitcoin has completed its main wave 4, forming a bull trap, and is now in the process of completing the main wave 5.

On the fundamental side, we need to pay attention to a few key factors:

1-For one, the USDT.D% ( CRYPTOCAP:USDT.D ) is on the rise, and this could put downward pressure on the crypto market.

2-Another point is that the stock market is also trending upward, but unlike stocks, Bitcoin tends to react more negatively when the stock market declines.

3-The US 10-Year Government Bond Yield ( TVC:US10 ) also appears to be trending upward, causing riskier assets like stocks and Bitcoin to decline.

4-Additionally, geopolitical tensions, especially between the US and Venezuela over the past 72 hours, could also trigger further declines in Bitcoin if they escalate.

Considering all of this, I expect Bitcoin to continue its downward trend and test the heavy support zone($78,300-$71,280). The Potential Reversal Zone(PRZ) might serve as a rebound point for Bitcoin, but if the heavy support zone($78,300-$71,280) is broken, we could see a more severe sell-off in the crypto markets.

What do you think? Will Bitcoin drop below $70,000 or not? Let me know your thoughts!

Cumulative Short Liquidation Leverage: $97,100-$98,135

Cumulative Short Liquidation Leverage: $93,215-$94,130

Cumulative Long Liquidation Leverage: $80,263-$78,131

First Target: Cumulative Long Liquidation Leverage: $80,263-$78,131

Second Target: Potential Reversal Zone(PRZ)

Stop Loss(SL): $90,423

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

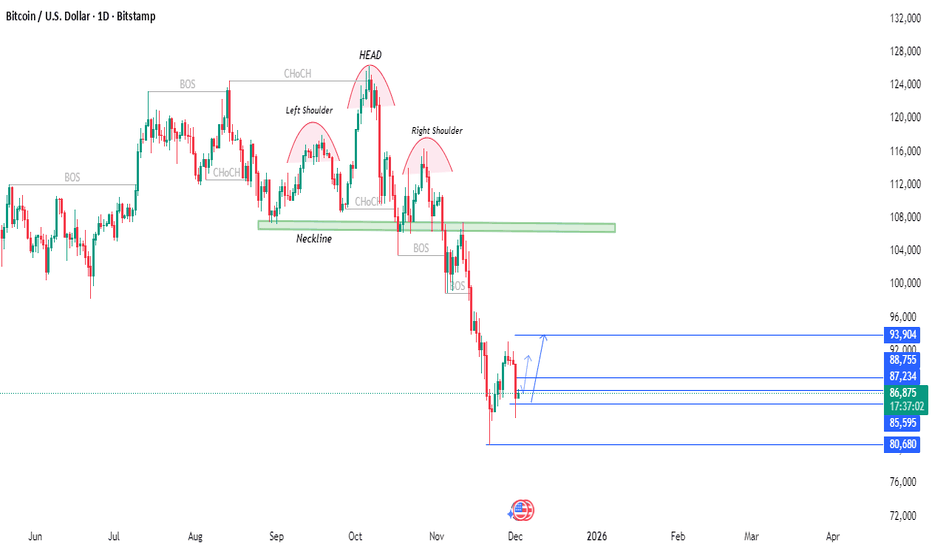

BTCUSD–Major Head&Shoulders Breakdown and Key Demand Zones AheadBTCUSD recently completed a clear Head & Shoulders reversal pattern, confirmed by a break of the neckline and a strong downside continuation. After the breakdown, price has reached an important demand area, where it is attempting to stabilize.

Left Shoulder – Head – Right Shoulder structure

Neckline break with BOS confirmations

Retest and continued bearish momentum

Multiple demand zones marked between 80,680 – 88,755

Short-term reaction pointing toward a potential relief move

Price is currently trading near the mid-zone around 86,900, where initial reactions have appeared. This zone may act as a reference point for observing market behavior, especially if buyers attempt a short-term recovery toward the upper blue zone.

This analysis focuses on how price action reacts within these key levels and structure changes

A Pullback Cannot Hide a Weakening TrendHello everyone, it’s Domic here ✌️

Looking at Bitcoin’s recent price action, you can probably feel that the latest drop wasn’t a random fall. The market completely broke through a multi-day equilibrium zone, and the moment BTC was repeatedly rejected at the EMA 89 and then lost the EMA 34, the balance of power shifted clearly toward the sellers.

Interestingly, right after that sharp breakdown, BTC bounced into a short-term pullback. This doesn’t signal a trend reversal; it’s simply the market’s natural reaction after falling too quickly: profit-taking from sellers, short-covering, and weak dip-buying flows creating a technical rebound — enough to rebalance the market, but not enough to change direction.

From a macro perspective, the signals are fairly aligned: US bond yields have risen again, the DXY has bounced from the 99 area, ETF inflows have weakened, and defensive sentiment ahead of upcoming US labour data has caused demand to dry up almost entirely. Crypto is simply being dragged along with the broader risk-off environment.

From a technical angle, BTC is trading below both the EMA 34 and EMA 89 — two downward-sloping moving averages indicating the trend remains bearish. The 4H breakdown accompanied by strong volume shows this is a real sell-off. BTC is currently pulling back to retest the resistance levels: 88,700–89,000 at the EMA 34 and 90,400–90,600 at the EMA 89. These zones will reveal whether selling pressure still dominates.

If sellers return aggressively, BTC may continue heading toward lower support regions: 85,500–86,000 is the first key area, followed by 83,000–84,000 — a demand zone that previously generated a strong bullish reaction. With the current momentum, the scenario where BTC at least touches the 85,500–86,000 support is becoming increasingly likely.

Which direction do you think the market is leaning toward? Feel free to share your perspective — and wishing everyone successful trading!

BITCOIN → The hunt for liquidity before the fallBINANCE:BTCUSDT.P continues to update lows within the global downtrend. The retest of 91K confirmed the dominance of bears...

The downtrend continues. The technical and fundamental situation for the crypto market is neutral to weak.

Bearish pressure held back the attempt to rise relative to 91K. The market is weak and not ready for growth. The subsequent decline broke the local structure, which generally indicates a bear market, but after updating the local minimum to 83700, a countertrend correction is forming. Zone of interest/break-even zone - 89K - 90K. A quick retest of these levels could trigger a downward pullback.

Resistance levels: 89K, 90K

Support levels: 85,400, 83,400

A retest of the range boundary and zone of interest could trigger a liquidity squeeze and a further decline if the bears keep the price below these boundaries.

Best regards, R. Linda!

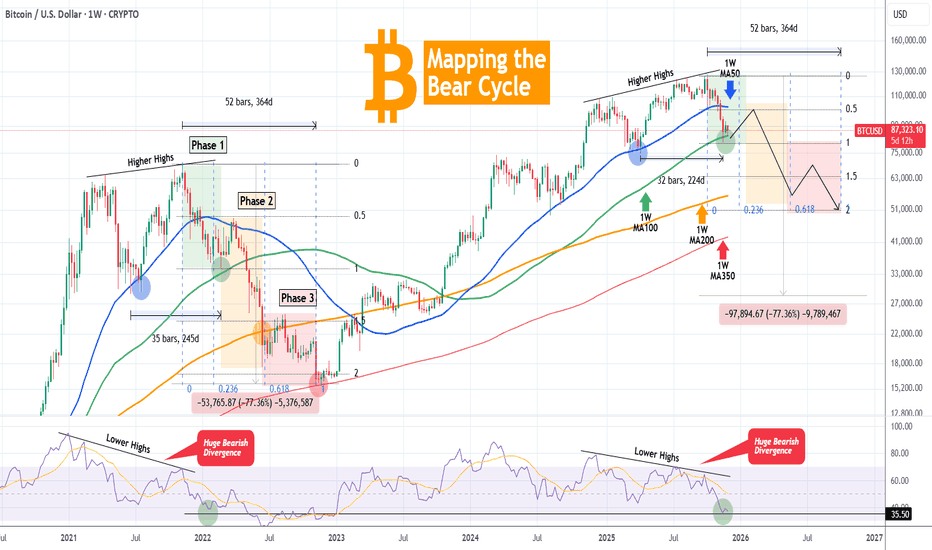

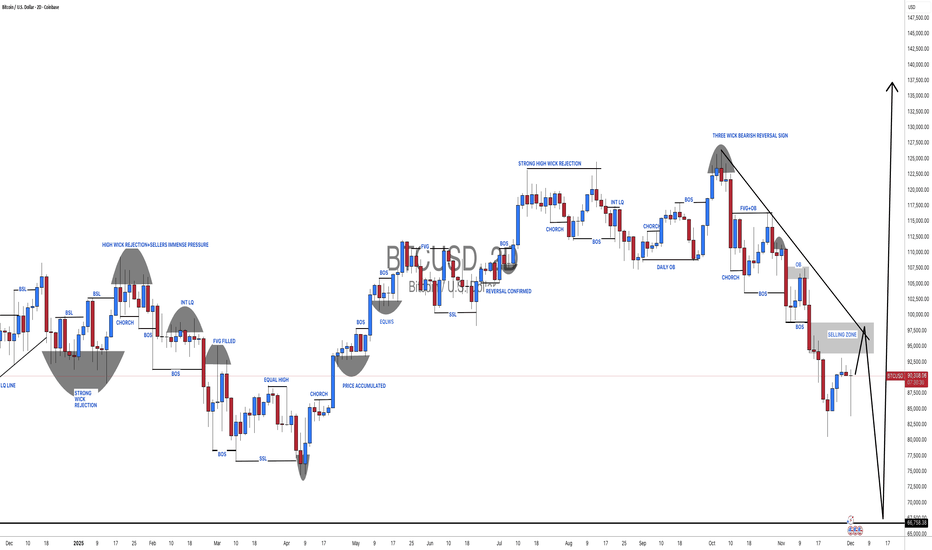

BITCOIN Can this Bear Cycle be mapped?Bitcoin (BTCUSD) is on its 3rd straight week of consolidation on its 1W MA100 (green trend-line) after marginally breaking below it (green circle). We've shown in previous analyses how the build up, including the Higher Lows trend-line (1W RSI Lower Highs Bearish Divergence) and the 1W MA50 (blue trend-line) rebound, of the 2025 Bull Cycle High, mirrors the 2021 peak formation.

Given the strong similarities, there are valid probabilities suggesting that those can expand into the Bear Cycle too. And this is what we attempt to do on today's post, mapping the new Bear Cycle based on the 2022 price action.

As you can see, we have classified the 2022 Bear Cycle into three phases. The key characteristic of those is MA contact. Phase 1 ends when the price hit the 1W MA100, Phase 2 when it hits the 1W MA200 (orange trend-line) and Phase 3 the 1W MA350 (red trend-line). So far the symmetry is also high on the time range between the 1W MA50 and 1W MA100 contacts among the two fractals (245 days vs 224 days).

If this holds for the whole duration of the 2026 Bear Cycle as well, we can expect it to roughly be 52 weeks (364 days) from the Bull Cycle Top to the Bear Cycle bottom, like the 2022 sequence.

The time Fibonacci levels help at maintaining a sense of positioning within the Bear Cycle, with the 0.236 Fib being just before Phase 1 ends and Fib 0.618 when Phase 2 makes contact with the 1W MA200.

Even though a straight up repeat of the -77.36% decline of the 2022 Bear Cycle would put the potential new bottom just below $30k, a Fibonacci extension symmetry suggests that Fib 1.0 was the Low we just made (1W MA100), Fib 1.5 ext around the time the price makes contact with the 1W MA200 and Fib 2.0 when the Cycle bottoms.

This indicates that $63900 is the first point of interest (and potentially start of buying) and $51000 the potential bottom.

Would you agree with this mapping? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

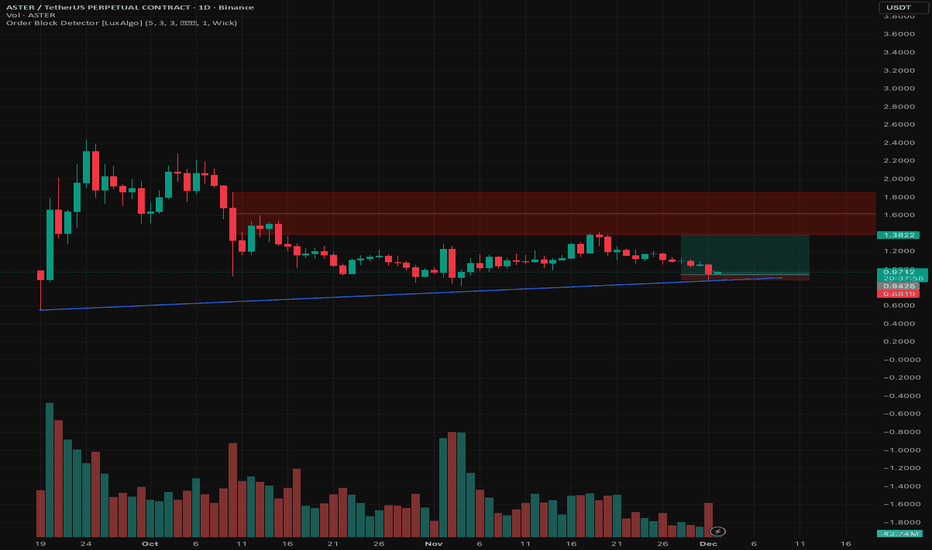

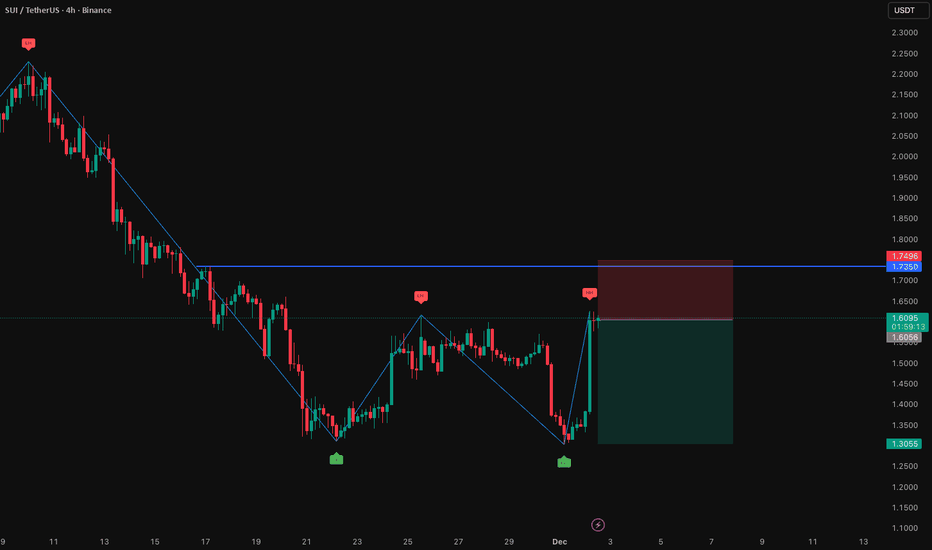

Swing trade opportunity for AsterAfter a good week of heavy selling pressure, I think mostly due to the fact there is a lot of airdrops being released (I received a good portion of USDF rewards too on asterdex), as well that Bitcoin is doing a healthy correction, I expect the price to stabilize again.

I have spot holdings for the long-term but this is my idea for a leveraged short-term trade over the next weeks / months at most.

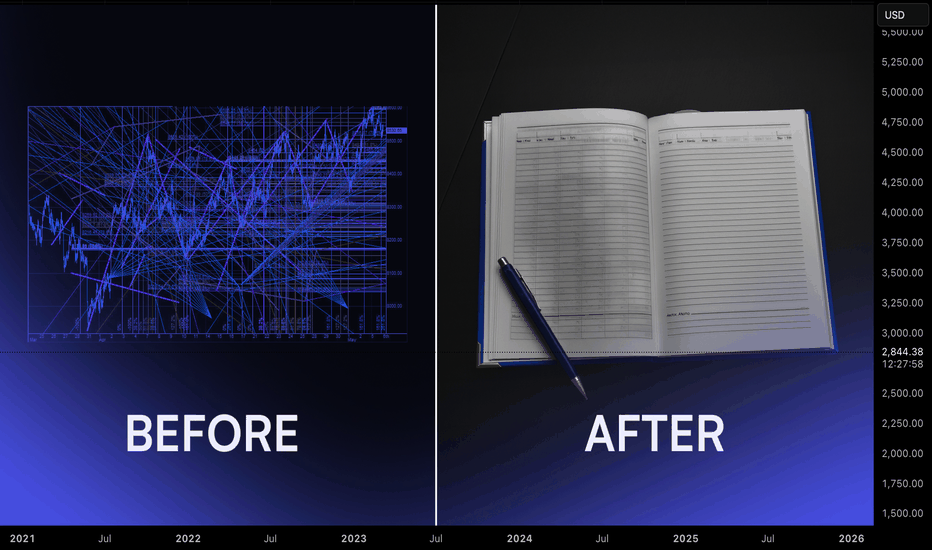

The Trade You Don’t Take!Most traders focus on entries, strategies, indicators, patterns…

But the truth is: your biggest edge is avoiding low-quality trades.

The market rewards patience far more than prediction.

Here’s the framework professional traders use to filter noise from opportunity, something 90% of traders overlook:

1. The Market Must Be Aligned

Before placing any trade, ask one question:

“Is the market trending, ranging, or correcting?”

Your strategy only works in the right environment.

A breakout strategy fails in a choppy range. A mean-reversion setup dies in a strong trend.

Identify the environment first, then choose the setup.

2. Your Levels Must Be Significant

True opportunity comes from reaction points, not random prices.

Look for:

- Major swing highs and lows

- Weekly or monthly levels

- Clean trendlines with multiple touches

- Areas where price previously paused, reversed, or consolidated

If the market isn’t near one of these levels, you’re trading in the middle, where noise lives.

3. Your Risk Must Make Sense

A good setup with a bad risk-to-reward is a bad trade.

Professionals only act when:

- The stop-loss is logical (protected behind structure)

- The target is realistic

- The reward outweighs the risk

If the math doesn’t work, the trade doesn’t happen.

🧠 The Hidden Lesson

Great traders don’t trade more, they filter more.

Your account grows not by finding better entries,

but by avoiding the trades that drain your capital, energy, and confidence.

Master the art of waiting, and your strategy will finally start working the way it was designed to.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

BTCUSD Short-Term Setup: Buyers Defend Support, TP1 at $89,200Hello traders! Here’s my technical outlook on BTC/USD based on the current market structure. After reaching the Seller Zone near $92,000, the price once again faced strong rejection, forming a clear reversal right under the descending Trend Line. This confirms that sellers continue to defend this area and keep Bitcoin within a broader corrective structure. From there, BTC pulled back toward the Buyer Zone around $86,000–$85,500, which has acted as a reliable support multiple times in the recent sessions. The market is now forming a potential short-term recovery after a fake breakout below this zone, highlighting attempts from buyers to regain control. However, as long as the price trades below the Seller Zone and the descending Trend Line, bearish pressure still dominates the chart. The structure suggests that Bitcoin may attempt a move toward TP1 at $89,200, where the market previously consolidated and faced resistance. A clean rejection from the Trend Line could send the price back toward support for another test, while a confirmed breakout above $92,000 would shift short-term sentiment and open the way for stronger bullish continuation. On the other hand, a breakdown below $85,500 could expose BTC to deeper declines toward lower support lines. Please share this idea with your friends and click Boost 🚀

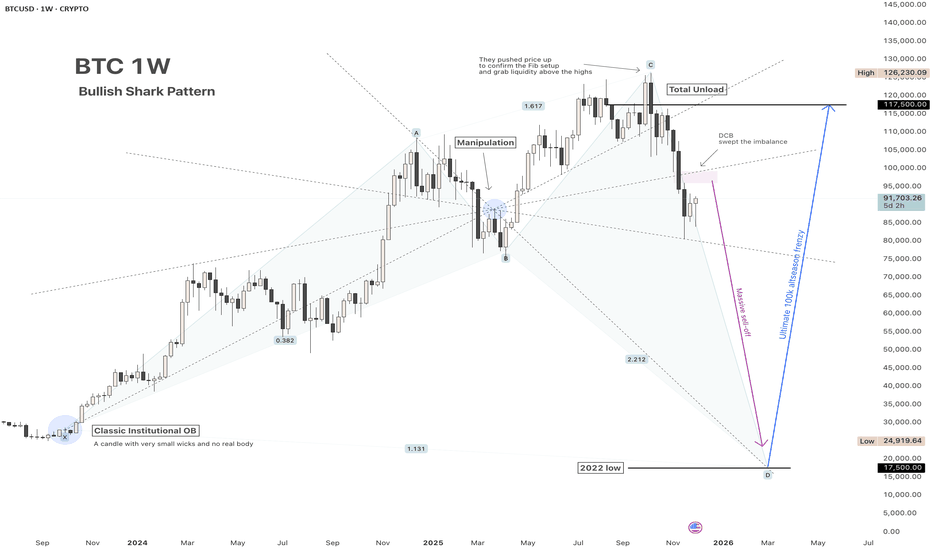

BTC Bullish Shark Pattern: DCB or Moon?BTC 1W – Bullish Shark forming. After the ‘total unload’ and a potential liquidity sweep into the 2022 lows (final D leg), I’m looking for the ultimate reversal that could launch the new epic parabolic leg toward 100k+ and a full‑blown altseason

Market stays bullish if this pattern fails to play out in the DCB zone

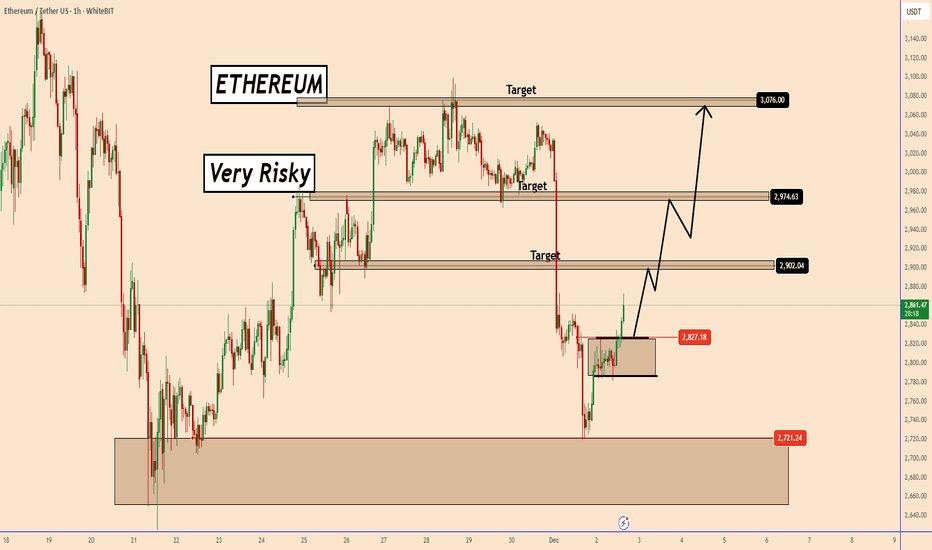

Ethereum Rebounds: Bulls Targets 2902 → 2974 → 3076Ethereum Rebounds: Bulls Targets 2902 → 2974 → 3076

Ethereum is showing renewed strength after bouncing from the key demand zone near 2720.

Price broke out from a bullish continuation pattern.

As long as ETH holds above small zone near 2827 , the market is likely preparing for the next leg up.

The breakout from the pattern triggered a continuation toward the first target at 2902, where the market may briefly correct before extending higher toward 2974.

If bullish momentum continues, the final upside objective sits near 3076, which aligns with a strong liquidity and supply area.

Key Targets: 2902 → 2974 → 3076

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

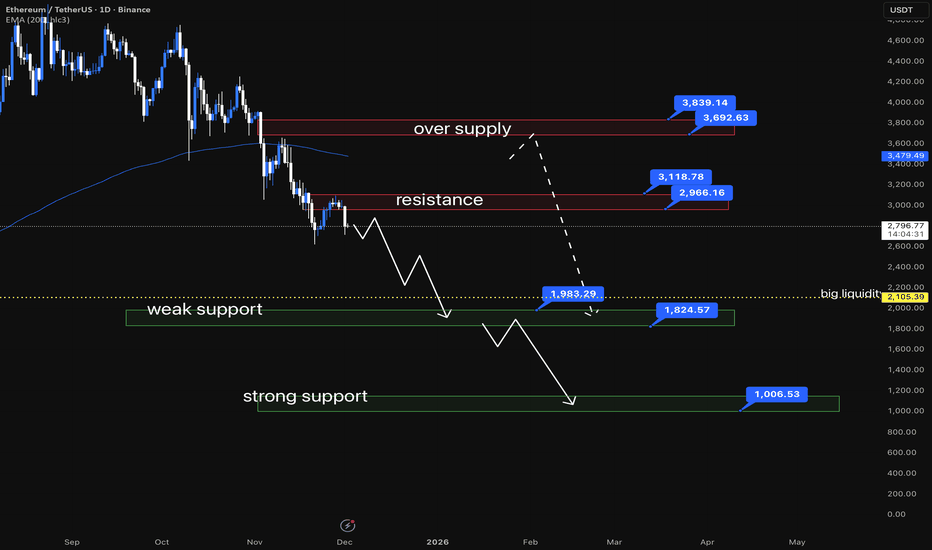

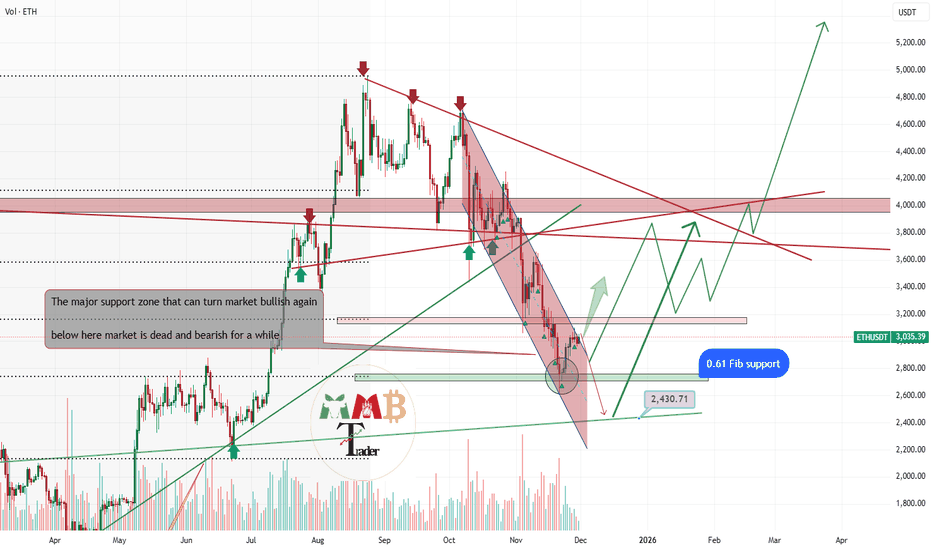

ETHUSDT /// 2DECEthereum lately has been showing signs of weakening after losing the support area around $3400–$3600. With this break, the market structure has shifted toward a more bearish tone, meaning the asset may continue forming lower highs and lower lows as long as downward momentum remains dominant.

At the moment, price reactions around the $3000 zone suggest that supply is still relatively strong. If this structure continues, several potential bearish paths remain valid.

⸻

Possible scenarios toward the $2000 region

Scenario 1

If the $3000 area acts as a local high, Ethereum could continue its downward trajectory toward the $2000 zone.

In such a case, the price might develop smaller corrective upward movements within the broader bearish leg.

⸻

Scenario 2

Another possibility is that the $2800 area generates a short-term bullish reaction.

Such a move could push the price toward the $3600–$3800 range before facing renewed selling interest.

If that happens, a continuation toward the $2000 zone could remain on the table.

⸻

General outlook

In both scenarios described above, a revisit of the $2000 area is one possible development based on the current technical structure.

This outlook is purely scenario-based and may change if the market structure shifts.

⸻

About the possibility of $1000 ETH

Reaching the $2000 zone does not automatically imply deeper downside.

However, the manner in which price approaches that area could provide clues:

• A sharp, capitulation-type decline toward $2000 might suggest that a local bottom has formed.

• A slow, corrective decline could indicate weakening momentum, in which case observing price behavior after reaching $2000 becomes important.

If bearish continuation patterns appear at that stage, lower levels — including the $1000 region — cannot be ruled out as long as the downtrend structure persists.

Once price interacts with the $2000 zone, I will share an updated analysis based on the new market structure.

#BITCOIN: Still Expecting Price To Touch $60K To $65K! Bitcoin is likely to drop further down before we could see a strong bullish move taking price to all time high. This is our view only and it is not an guaranteed move; once price touch our reversal zone then we could see price going back to all time high. Good luck and trade safe!

Team Setupsfx_

Like And Comment Our Ideas For More Such Educational content! 📊🚀

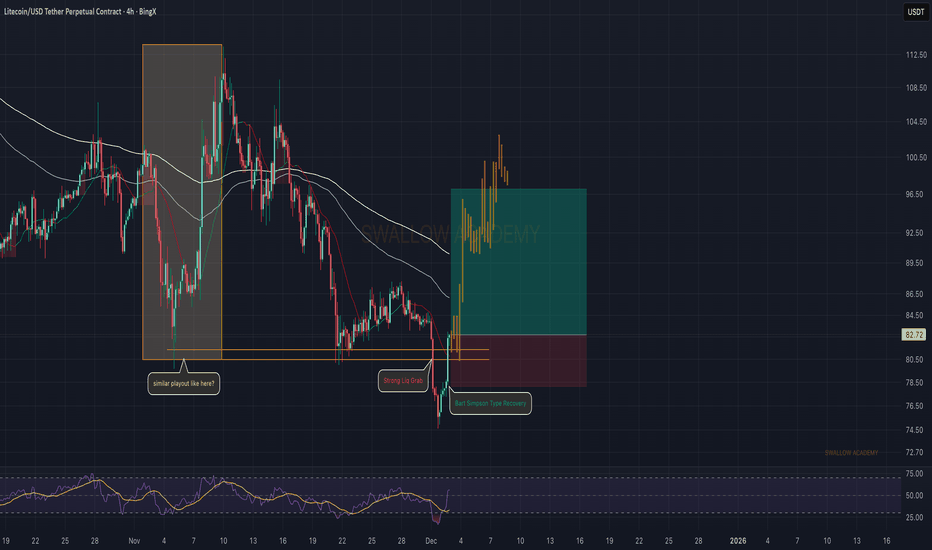

Litecoin (LTC): Seeing Similar Pattern | Bart Simpson PushLTC pulled a strong liquidity grab and instantly recovered with a classic Bart-Simpson type move — very similar to the playout we had earlier in November. If buyers manage to hold this recovery structure and keep pushing above the EMAs, we could see another upside leg forming the same way.

As long as price stays above the grab zone, momentum stays on buyers’ side and this setup remains valid for continuation.

Swallow Academy

ETHUSDT Major breakout and pump may happen soonA decisive breakout above the $3,100 level for Ethereum would represent a significant technical milestone, potentially heralding the beginning of a new bullish phase. Such a move, particularly if validated by sustained volume and a daily close above this key resistance, could initiate a strong upward impulse with an initial technical target near the $5,000 zone, aligning with measured move projections from the recent consolidation structure.

It is important to emphasize that a confirmed breakout of the prevailing channel resistance is a prerequisite for this bullish scenario to unfold. Based on current technical structure and momentum indicators, we assess the probability of such a breakout occurring in the near term at approximately 70%, though traders should await clear confirmation before positioning for extended upward movement.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

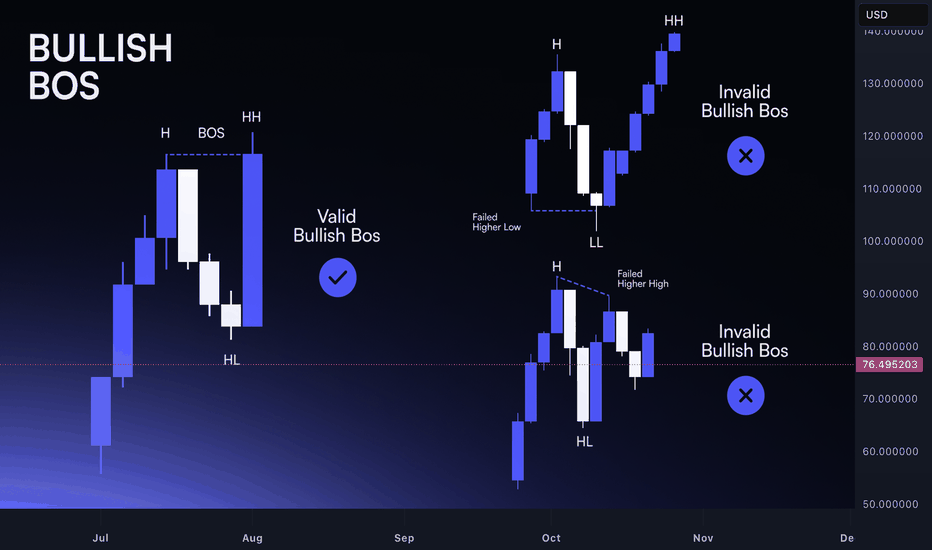

Break of Structure: Identifying Real Trend Shifts Markets move in phases, and structure is the clearest way to read those transitions. A trend doesn’t reverse because price slows down or because a candle looks different. It reverses when the underlying pattern of highs and lows breaks.

Understanding this sequence is what separates disciplined analysis from reactive guessing.

In an uptrend, buyers defend higher lows and push price into higher highs. As long as this structure holds, the trend is intact. Noise may create deep pullbacks or temporary hesitation, but the narrative remains unchanged.

The first sign of vulnerability appears when price fails to create a meaningful higher high. Momentum stalls, and the next push upward shows less conviction.

The real shift comes when a higher low is taken out. This is the break of structure. It shows that buyers no longer control the market, and sellers have absorbed enough liquidity to push through a prior defensive point.

This is not a prediction; it’s an objective change in the market’s behaviour. A single candle doesn’t define it. The sequence does.

For downtrends, the logic is the same in reverse. Lower highs and lower lows define control. When price fails to print a clean lower low and then breaks a prior lower high, the trend loses integrity. Structure reveals the turning point before sentiment catches up.

However, not every break is a real shift. Crypto produces countless intraday spikes that violate levels without altering the broader narrative.

The difference lies in context. A valid break is supported by:

– Clear momentum into the break

– Liquidity taken before the shift

– Follow-through after the level is broken

– A retest that confirms the new direction

These factors filter out noise and highlight genuine transitions. Watching price break structure is not enough; you must also assess whether the move fits within the larger story of the trend.

A break of structure doesn’t mean instant reversal. It means the previous trend has ended. The next phase might be consolidation, re-accumulation, or immediate reversal, but the bias shifts the moment structure changes.

Traders who read structure objectively adjust earlier and avoid fighting a direction that no longer has control.

Once you internalize how highs and lows interact, spotting real shifts becomes a structured process instead of an emotional reaction. Structure turns confusion into clarity and gives you a reliable framework for navigating both trends and transitions.

Are you people crazy? Did you not learn from the 2022 crash?I didn't think it was necessary to publish anything, at least until next year. It was clear to me, and it's even clearer now, that BTC is on the path of decline. Yet, since the end of November I've started hearing rumors of a bull run, that BTC has hit the bottom and will now FOR SURE go back to 127,000...

Either you've all gone crazy, or someone is trying to get retail investors to buy so they can happily dump in their faces.

I won't name names, but one of these con-artists has a name that start with M and ends with K.

Keep your hands on your ass; DON'T BUY!

The market is going down and will stay down until at least January.

And if by chance there should be a pump back up to 127,000, don't be amateurs; wait to get back to the top and then sell, even your grandmother.

And for the love of God; if you use perpetuals, have at least the decency to buy AND sell at the same time, keeping your SL very, very, far from the Fair Price.

Why is going down? Well, i have another name for you: it starts with T and ends with P. If you want to measure how healty is the market keep an EYE on the POTUS Coin.

A lot of people already lost a lot of money.

Be smart; crypto ARE NOT for betting junkies.

Journaling For Traders: Turning Random Results Into A Feedback Most traders spend years tweaking indicators and strategies while leaving their process undocumented. Without a journal, every trade feels new, every mistake repeats, and progress stays vague. A structured journal turns experience into data. It shows what you do well, what keeps failing, and which behaviours appear before your best and worst decisions.

The first step is simple: record every trade. Log the setup, market structure, entry reason, risk, and emotional state. Write whether you felt rushed, confident, bored, or frustrated. Do not only record wins or big losses. Incomplete data keeps blind spots alive.

The real value appears during weekly review. Set time aside after markets slow down and go through the trades as a batch. Look for recurring situations. You may notice that late-session entries perform poorly, that you increase size after wins, or that you cut trades early when size feels uncomfortable. These patterns are not visible inside a single session. They emerge only over a cluster of trades.

Next, extract insights. Group trades by setup, session, and emotional state. Identify your highest quality combinations. For example, trend continuation trades in London with fixed risk might show a strong performance profile while countertrend entries in low volume hours consistently underperform. This step separates what you think works from what actually delivers.

Finally, adjust strategy. Turn observations into rules. Reduce or remove the behaviours that repeatedly drain capital. Formalise the conditions that define your best trades. Add small process rules rather than full rewrites, then track the impact in the next review cycle. Over time, your playbook becomes evidence based rather than theoretical.

Journaling is not an extra task for perfectionists. It is the operating system behind professional execution. When you continuously record, review, extract, and adjust, your trading process compounds in quality even when individual weeks are difficult.

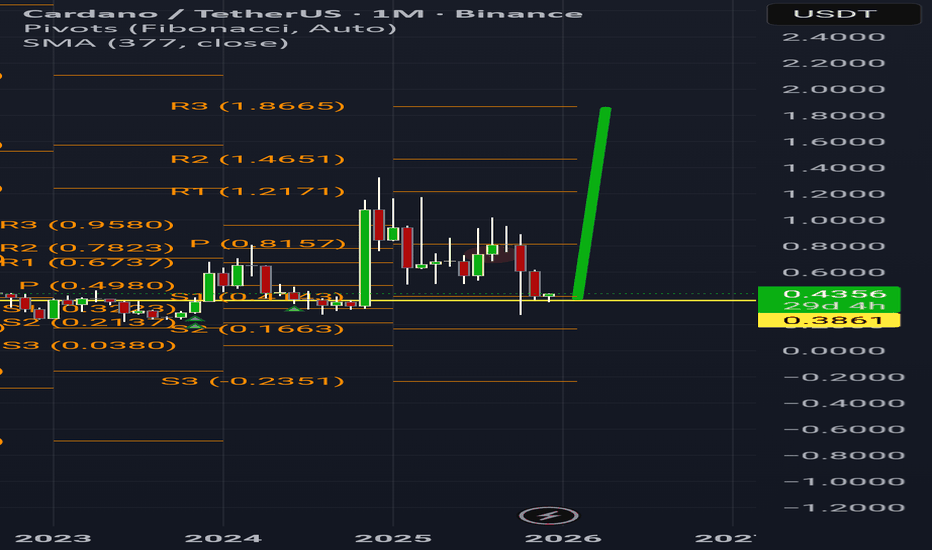

Ada 400% pump to R3Last 2 days we had a proper bear trap below support, but now we are flying above, and looking to push towards new highs.

I believe this is the beginning of something special for crypto but mostly ADA, im a big fan! Things are looking great for a beautiful bottom.

Together with the diamond bottom pattern on another chart, Im looking for R3 TO BE ONLY THE BEGINNING of this beautiful new Bull Run ❤️