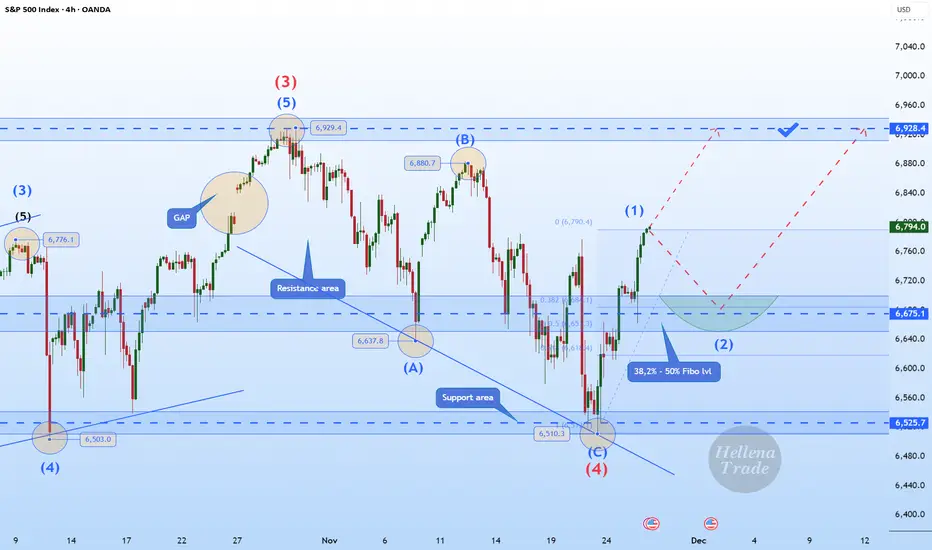

Colleagues, we continue the previous scenario of upward movement in the impulse “12345”.

I expect a small correction in the middle order wave “2” approximately to the area of 38.2%-50% Fibonacci levels (6675).

Then I expect a continuation of the upward movement to the maximum of the wave "3" of the higher order 6928.4.

It is possible that the first wave may be stretched, which may mean a correction-free movement to the target.

Fundamental Context.

Market sentiment remains cautiously bullish ahead of this week’s US data releases. Investors continue to price in a softer Fed policy path for 2026, which supports the equity market after the recent correction.

US Treasury yields remain under pressure, and the latest macro indicators — especially labor market cooling and weaker business activity components — reinforce expectations of an economic slowdown. This backdrop typically favors equity upside as markets look ahead to potential policy easing.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

I expect a small correction in the middle order wave “2” approximately to the area of 38.2%-50% Fibonacci levels (6675).

Then I expect a continuation of the upward movement to the maximum of the wave "3" of the higher order 6928.4.

It is possible that the first wave may be stretched, which may mean a correction-free movement to the target.

Fundamental Context.

Market sentiment remains cautiously bullish ahead of this week’s US data releases. Investors continue to price in a softer Fed policy path for 2026, which supports the equity market after the recent correction.

US Treasury yields remain under pressure, and the latest macro indicators — especially labor market cooling and weaker business activity components — reinforce expectations of an economic slowdown. This backdrop typically favors equity upside as markets look ahead to potential policy easing.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Trade active

Colleagues, I still think that the correction in wave “2” will take place, but maybe not as deep as I thought. This week I plan to see a correction to the 6720-6740 area, nevertheless the upward movement is still in priority and I recommend to work with pending limit orders.✅ Free TELEGRAM channel: t.me/HellenaSignals

🌅 INSTAGRAM: instagram.com/hellena_trader

🟢 Contact: t.me/Hellena_FX

🌅 INSTAGRAM: instagram.com/hellena_trader

🟢 Contact: t.me/Hellena_FX

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Free TELEGRAM channel: t.me/HellenaSignals

🌅 INSTAGRAM: instagram.com/hellena_trader

🟢 Contact: t.me/Hellena_FX

🌅 INSTAGRAM: instagram.com/hellena_trader

🟢 Contact: t.me/Hellena_FX

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.